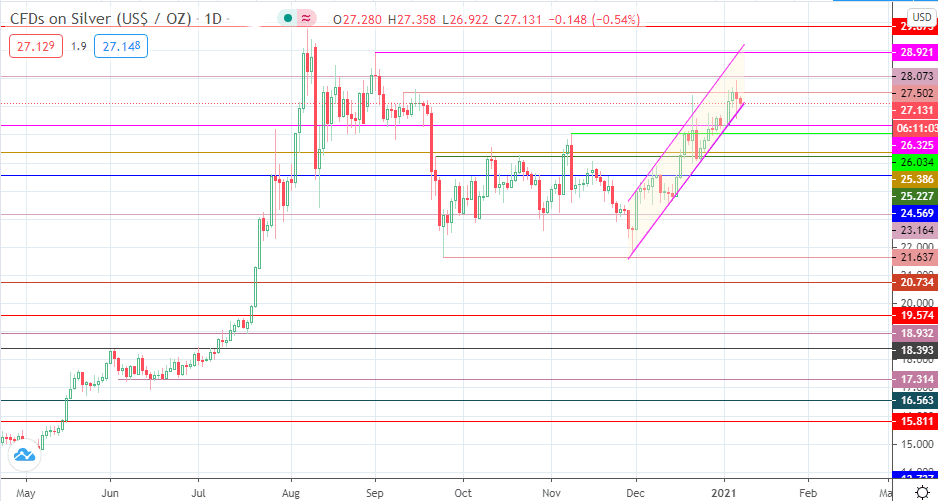

- Silver price action heads lower for the 2nd day in a row, but the ascending channel's trend line holds firm as support at $27.

Silver price on the XAG/USD charts extended losses into the second day, as higher bond yields in the US and a stronger greenback put pressure on the white metal in Thursday’s trading session. However, the downside move appears to have been limited by the lower edge of the ascending channel, which comes in at the psychological price level of $27.

Spot metals took a general hit on Thursday as the US Dollar firmed across the board and forced lower metal prices. However, it is still unclear what impact a Biden government will have on the greenback in terms of policy actions. With Democrats now controlling both legislative houses, it would be easier to pass the additional fiscal stimulus, which could boost growth, raise inflation and allow for more demand for risky assets as the Fed tilts towards a hawkish direction. On the other hand, rising bond yields and more deficits favour greater bearishness on risky assets.

Silver price is trading lower by 0.7% on the day.

Technical Levels to Watch

The lower edge of the channel is supporting the daily candle at 27.00. A breakdown of this border allows silver price bears to target 26.325, with 26.034 and 25.386 as the immediate downside targets.

On the flip side, a bounce on the lower boundary allows the silver price to aim for the 27.502 resistance initially, with 28.073 and 28.921 serving as additional downside targets.