- The Shell share price is on course to hit the 1800p resistance mark as the company's share buyback program stokes investor interest.

The Shell share price is trading lower after it gave up its intraday gains at the start of the New York trading session. The stock had begun the day on the FTSE 100 strongly on the back of positive news of a pacy shares buyback.

The company had announced on Friday that it would pursue a share buyback program at pace, with some of the proceeds of the $5.5 billion earned from the Permian sale to be used to fund the buyback. An initial $1.5billion had been spent on the buyback in December 2021, in a process that will end this January.

The company’s shareholders had voted overwhelmingly in December 2021 to support moving the company’s corporate headquarters back to London and the end of the dual share structure. Shell’s Q4 earnings are expected on 3 February, with analysts projecting a profit of $1.45 per share.

Shell Share Price Outlook

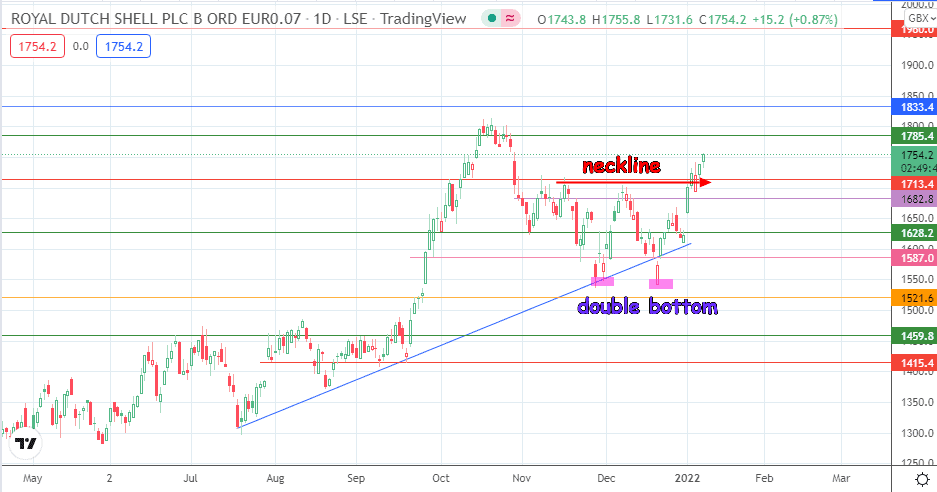

The daily chart shows a completed double bottom pattern, with the measured move projected to touch off the 1800 psychological resistance. The bulls need to take out the intraday resistance at 1760.0 (27 October 2021 low) for this move to come to fruition. The 1785 price mark also serves as a barrier that could resist the completion of this move.

On the flip side, a further decline targets 1713.4 as the preliminary support. If the bulls fail to defend this level, 1682.8 comes into the picture before 1640.0 (7 October/4 November 2021 lows) form the next available downside targets.

Shell: Daily Chart

Follow Eno on Twitter.