- A rising wedge pattern shows that the Shell share price is in trouble. We explain why the stock could drop soon.

The Shell share price dropped by more than 2% on Thursday as investors reacted to the company’s warning about its exit from the Russian market. The stock dropped to a low of 2,077p, which was slightly below the highest point this year. However, it has still risen by more than 25% year-to-date, making it one of the best performers in the FTSE 100. The company has also outperformed BP, but it has lagged supermajors like ExxonMobil and Chevron.

Why has Shell stock risen?

Shell, formerly known as Royal Dutch Shell, has been in the spotlight in the past few months. For example, in the fourth quarter of 2021, an activist investor bought the stock and advocated breaking it to create value for shareholders. The firm balked at the proposal and then went forward and transformed itself from being a Dutch to a UK company.

Shell has also benefited from the ongoing resurgence of crude oil and natural gas prices. Indeed, it is struggling to meet demand in some countries while prices have remained at elevated levels. On the other hand, Shell was one of the first companies to announce that it would exit the Russian market. And today, the management predicted that this exit would cost it about $5 billion, which is a substantial sum.

As part of its Russia divorce, the firm has ended its JV with Gazprom and said that it would stop buying Russian cargo. It will also close all its retail divisions in the country. The statement added:

Reflecting the unprecedented volatility in commodity prices prevailing up to the end of the quarter, material additional movements could be seen in CFFO (Cash Flow From Operations) from margining effects on derivatives, changes in inventory volumes and in accounts payable and receivables.”

So, will the Shell share price keep rising? Shell is set to benefit in the long term because analysts expect that oil and gas prices will remain at elevated levels for a while. As a result, it will continue delivering strong shareholder returns.

Shell share price forecast

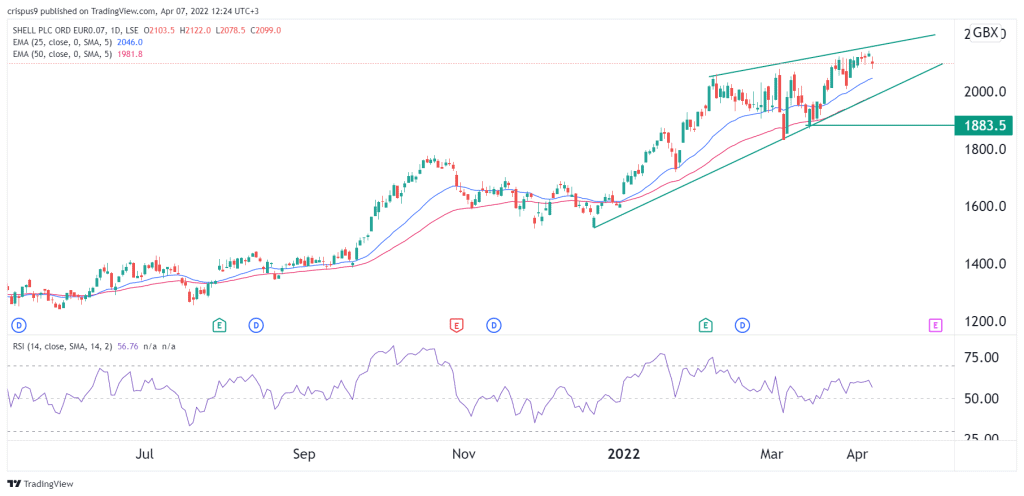

The daily chart shows that the Shell stock price has been in a strong bullish trend in the past few months. This trend is because of the company’s undervaluation and the fact that oil and gas prices have been strong. The stock remains above the 25-day and 50-day moving averages.

But, a closer look shows that the stock has formed a rising wedge pattern, which is usually a bearish sign. Therefore, as this wedge nears its confluence zone, we can’t rule out a major drop in the stock. If this happens, it will retest the support at around 1,833p. As such, while Shell has strong fundamentals, a huge drop can’t be ruled out.