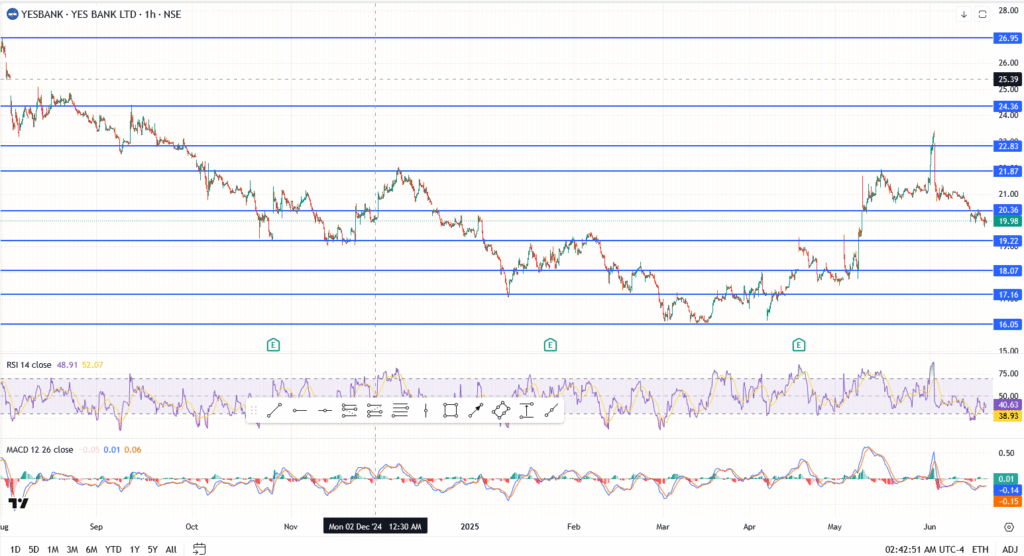

Yes Bank (NSE: YESBANK) may have gotten a credit rating upgrade from Moody’s, but the share price hasn’t quite followed through. At the time of writing, the stock is trading near ₹19.98, stuck just below a stubborn resistance zone around ₹20.36. It’s a familiar pattern: good news on paper, but the chart still says “wait.”

Moody’s bumping the bank to Ba2 on improved capital buffers and a better credit profile was supposed to be the big push. Add to that, Nomura’s bullish take, comparing Yes Bank favorably with IndusInd and RBL Bank. But so far, the market isn’t chasing.

What’s Holding the Rally Back?

Yes Bank has done a lot of clean-up work. Moody’s acknowledged the capital raising, NPA management, and deposit stability. But stock momentum still seems cautious. Traders may be waiting for volume-backed confirmation above key chart levels, not just headlines.

The problem? Most short-term players were already positioned for the upgrade. So, when it finally hit the wires, it got priced in fast.

Yes Bank Share Price Today: Key Technical Levels

- Current price: ₹19.98

- Immediate resistance: ₹20.36

- Next resistance: ₹21.87, then ₹22.83

- Support zones: ₹19.22, then ₹18.07

- RSI: 48 neutral, slightly weakening

- MACD: Flat, slight bearish bias

If bulls can’t break above ₹20.36 with conviction, a drift back toward ₹19.22 or even ₹18.07 is likely. On the flip side, reclaiming ₹21.87 would shift sentiment sharply.

Is the Moody’s Upgrade Already Priced In?

Maybe partially. But long-term investors will see it as confirmation that Yes Bank’s turnaround is gaining traction. If follow-up earnings and loan growth match expectations, this could be a base forming, not just a bounce.

Nomura’s note adds weight, especially their positioning of Yes Bank in the same breath as IndusInd. But technicals still hold the key. Until ₹20.36 breaks with strength, the stock may remain in consolidation.

Conclusion

Yes Bank’s share price is hovering, not rallying, despite a clean rating boost and improved sector sentiment. The bulls need more than headlines now. They need follow-through.

₹20.36 is the level to beat. ₹19.22 is the line to hold.

It’s a tug-of-war between improving fundamentals and cautious short-term flows. And for now, the chart is keeping everyone honest.