- Yes Bank's share price drops below ₹19.50 as the Anil Ambani ED probe continues. Get analysis on the reasons for the decline and the stock's future outlook.

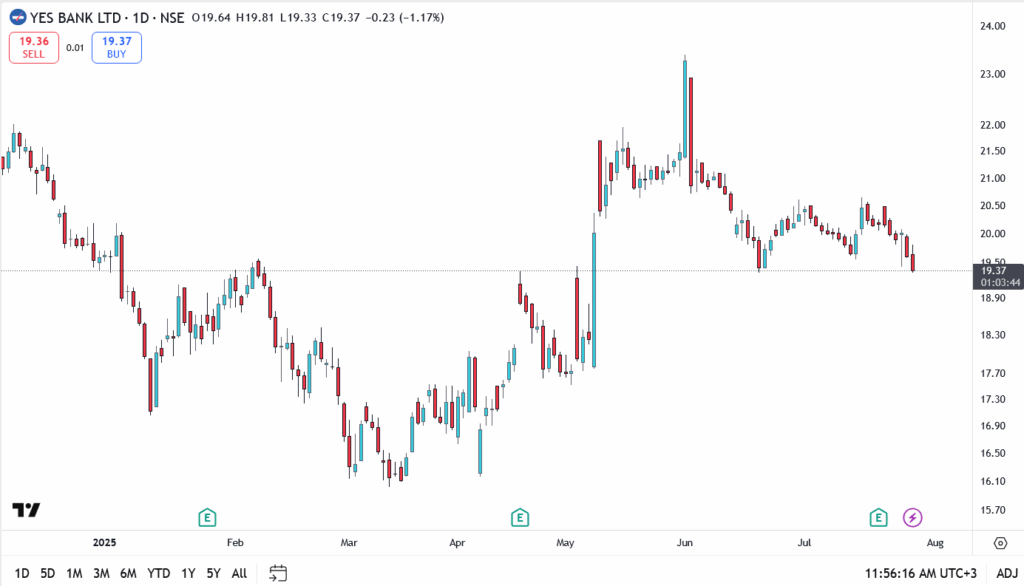

Yes Bank’s share price opened the week on the back foot, slipping over 1% to ₹19.37 on Monday, as the Enforcement Directorate continued its raids in a ₹3,000 crore loan fraud investigation. While headlines last week revealed the scope of the ED probe, today’s price action reflects growing market unease around regulatory overhang and reputational risk.

ED Investigation Deepens, Investor Anxiety Builds

The third consecutive day of ED searches across companies tied to Anil Ambani’s Reliance Group has raised questions over whether more linked disclosures could emerge in the coming days. While Yes Bank has not been officially named in the fresh batch of findings, traders worry about deeper fallout if loan restructuring details from the 2020 bailout resurface.

Importantly, this isn’t about new fraud but about the legal clean-up of legacy issues, some of which the current management has already disclosed. Still, the optics of another high-profile corporate probe tied to the bank’s past are clouding sentiment.

Legal Overhang Stalls Momentum

Yes Bank’s price was already struggling to reclaim higher levels after slipping from its June high of ₹23.10. With today’s move, Yes Bank is now down more than 16% from that swing high, with retail confidence visibly eroding.

Some fund managers had started accumulating the stock for its turnaround narrative. But that rotation has stalled as legal headlines dominate, pushing volumes lower and leaving the stock exposed to further drift.

Yes Bank Share Price Technical Analysis

- Current price: ₹19.37

- Resistance: ₹20.50, ₹21.75

- Support zones: ₹18.90, then ₹17.30

Conclusion

Yes Bank’s recovery narrative is still alive, but momentum has stalled. Right now, traders seem less interested in quarterly numbers and more focused on how this investigation plays out. Unless the bank comes forward with a strong statement or shores up investor confidence with fresh capital measures, any near-term bounce could be short-lived.