Walmart shares dropped more than 5% on Thursday after the company raised its full-year guidance and posted strong Q2 revenue growth. Profit pressures tied to tariffs and inflation spooked investors, overshadowing a top-line beat. On Friday, the stock is steady in pre-market trade around $98 as the market weighs whether the selloff was an overreaction or the start of a deeper pullback.

Why Did Walmart Stock Drop After Earnings?

Walmart turned in another quarter of sales growth, with fiscal Q2 revenue climbing 4.8% to $177.4 billion. The strength came from a 25% surge in e-commerce and steady same-store gains. Its push into advertising also continues to pay off, with ad revenue up 46% as Walmart deepens the monetization of its digital platforms.

Earnings, though, told a different story. Adjusted EPS landed at $0.68, shy of the $0.73 analysts were looking for. Rising tariff costs and thinner margins ate into the top line. Even as management raised full-year guidance, calling for 3.75–4.75% sales growth and EPS in the $2.52–$2.62 range, the market wasn’t impressed. The miss on profit was enough to spark Walmart’s sharpest one-day selloff in months.

Walmart Stock Technical Analysis

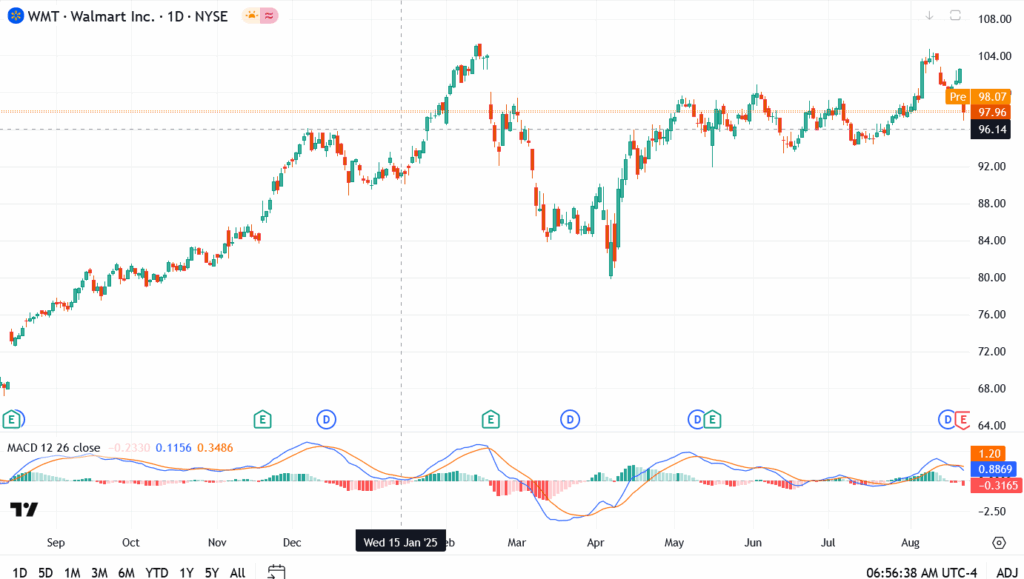

- Current price: $97.96 (pre-market $98.07)

- Pivot level: $98.00

- Immediate resistance: $101.50, then $104.00

- Support: $96.00, then $92.50

WMT slipped under its $98 pivot on Thursday before finding support near $96. If the stock fails to hold that level, the next cushion sits at $92.50. On the upside, a rebound above $101.50 could revive momentum toward $104, last week’s high.

Walmart Stock Forecast: Can Bulls Regain Control?

The long-term story remains intact. E-commerce is scaling, advertising is a powerful margin driver, and Walmart+ membership continues to expand. But near-term, the market is focused on margins, not sales. Bulls need to see cleaner EPS delivery to justify chasing highs above $104. Bears argue tariff costs could linger into FY27, capping upside.

For now, WMT looks like a consolidation trade: steady on fundamentals but hostage to headlines on costs and trade policy. Traders should watch $96 on the downside and $101.50 on the upside for clues on direction.