Trent Ltd (NSE: TRENT) dipped on Thursday, with shares falling 1.22% to ₹5,291, even as the company posted a solid Q1 performance. The market’s reaction? Not exactly enthusiastic, but there’s more to the story than the red on screen.

The Tata-backed retailer reported a net profit of ₹430 crore, up 9% from last year, while revenue climbed 24%. EBITDA shot up by 38%, and margins widened by 240 basis points. Impressive on paper. But investors seem to be asking: how much of this growth is already priced in?

Can Trent Sustain Its 25% Growth Target Amid High Valuations?

Trent’s recent analyst meet offered a glimpse into its long-term playbook. Management hinted that a 25% revenue CAGR is sustainable, building on a five-year average of 35%. That’s ambitious, but if any Indian retailer can pull it off, it’s Trent.

The expansion pace hasn’t slowed either. The company added 1 Westside store and 11 Zudio outlets during the quarter. That brings its footprint even deeper into value-driven retail, a space that’s been seeing strong consumer traction post-COVID.

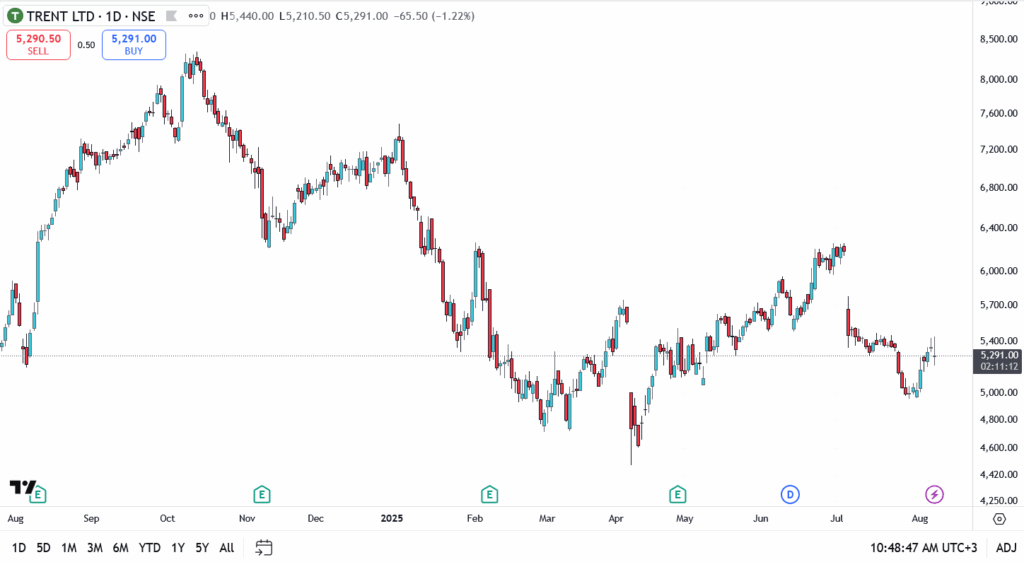

Yet despite the positive updates, Trent’s stock is down 25% so far this year, and off 36% from its 52-week high. Valuations remain a sticking point, the stock is currently trading at 82x FY27 estimated earnings. For many investors, that’s a tough pill to swallow, even with the growth narrative intact.

What the Business Update Tells Us

Earlier in the quarter, Trent revealed that standalone revenue rose 20% YoY to ₹5,061 crore, showing resilience across its formats. Zudio remains the star performer, but Westside continues to contribute meaningfully, a sign the dual-brand strategy is working.

Still, Thursday’s price action shows just how cautious the market has become. Good results aren’t enough. Investors want reassurance that margins can hold, that costs won’t balloon, and that the runway for expansion isn’t narrowing.

Trent Share Price Analysis

- Current price: ₹5,291

- Resistance: ₹5,400, then ₹5,625

- Support: ₹5,050, then ₹4,920