- Rio Tinto is riding on the strong rally by gold and attractive divestment plans

- Apple's AI prospects seem to be on the upside after trailing its tech peers for a long period

- Amazon is still strong in the AWS frontier and the holiday shopping season adds to the propulsion

Equity markets are in an interesting spot before the holidays, possibly setting up a Santa Rally. Some stocks that could do well today are Rio Tinto (LSE: RIO), Amazon (NASDAQ: AMZN), and Apple (NASDAQ: AAPL). This is based on recent positive market signs and good analyst predictions going into the end of the year.

Amazon Stock

Amazon’s e-commerce and AWS divisions could push its performance today. TipRanks analysts predict a more than 30% increase in 2026, spurred by revenue growth of over 10.5%, according to Yahoo Finance. Nasdaq points out that things like expanded spending could be viewed well by investors as the holiday season wraps up.

Also, Amazon’s strong logistics often helps it at the end of the year. S&P Global notes that AWS is seeing faster growth, with a 22% year-over-year increase in cloud sales. This is mostly from the strong demand for cloud infrastructure with AI. AWS brings in over 60% of Amazon’s operating profit, so this fast-growing area is overshadowing any concerns about retail profit margins.

Amazon Stock Price Prediction

Amazon stock has its daily chart RSI at approaching 50, which is neutral. The momentum will likely stay on the upside as long as the action is above the 10-day EMA at $226.76. The first barrier will be at the $230 mark, with a stronger momentum potentially resulting in further gains to $231.90. Primary support is at $225,below which the upside narrative will be invalid. The second support will likely be at $223.10.

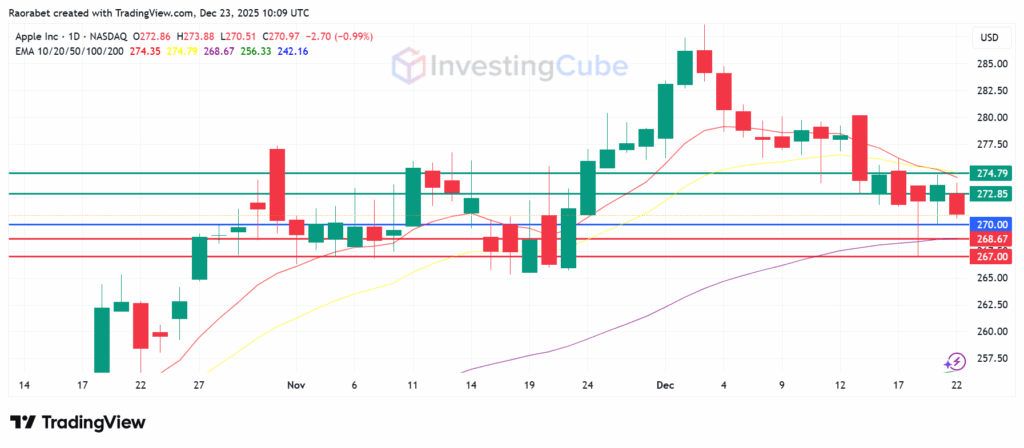

Apple stock daily chart with support and resistance levels created on TradingView

Rio Tinto

Rio Tinto could benefit from the rising gold prices. With gold hitting a high of $4,421 per ounce, mining companies with precious metal holdings are seeing a lot of money coming in. Also, good feelings from Asian markets, like the Nikkei’s 1.8% jump today, often affect London-listed miners.

The mining company’s focus on growing its copper and aluminum business has also caught investors’ attention and could help propel gains today. Reuters reports that it expects up to $10 billion in sales, which could increase earnings by half by the end of the decade due to careful spending and rising commodity prices. Iron ore is also at a 17-week high, putting Rio in a good spot to profit from rising prices and efficient operations.

Rio Tinto Share Price Forecast

Rio Tinto is currently moving upward, with the RSI at 76 signaling a strong bullish hold above the 5,830 p pivot. However, that also signals overbought conditions, which could reduce buying appetite above the upper Bollinger Band. Rio Tinto share price will likely meet the first hurdle at 5,950p and could target the psychological 6,000p if it manages to flip that mark into a support.

Conversely, the overbought conditions could favour the sellers to take control with the first support likely at 5,740p. An extended control by the sellers will break below that level and invalidate the upside narrative. Also, that could clear the path for further downside to test the support corresponding to the middle Bollinger Band at 5,602p.

Apple stock daily chart with support and resistance levels created on TradingView

Apple

Apple’s integration of AI features could be the spark that ignites its rebound. Analysts mention that Apple’s focus on privacy-focused, on-device AI processing, instead of rushing into generative tools, is starting to show results and address concerns about a lack of innovation. In late 2025, Morgan Stanley noted Apple’s move from being an AI laggard to a possible leader. The firm mentioned the upcoming re-release of Siri in spring 2026, using Google’s Gemini AI models, as a game-changer.

Morgan Stanley increased its fiscal 2026 iPhone shipment forecast to 243 million units, a 3.3% year-over-year increase. Also, it raised the EPS forecast to $8.14, due to AI innovations and design changes. Jefferies noted that the AI-driven Siri is speeding up capabilities, while the iPhone 18’s staggered release could smooth out revenue. As the holiday shopping season peaks, early data suggests the iPhone 17 cycle is selling better than expected in Europe and Japan.

Technical Analysis

Apple’s chart shows it last closed trading below 10-day EMA, and has been trading sideways for the last five sessions. Therefore. this potentially presents an entry opportunity if AAPL stock price stays above the $270 pivot mark. Immediate resistance will likely be at $272, near yesterday’s opening level. Action above that level will signal a stronger momentum that could push the stock to test $274.79, aligning with the 20-day EMA. On the downside, the first support is likely to be at the 50-day EMA at $268.67, below which the upside narrative will be invalid and another support could come at $267 near monthly lows.

Apple stock daily chart with support and resistance levels created on TradingView

Rio Tinto’s gains today are linked to the ongoing gold price rally, as well as growth in copper and aluminum. Plus, they might sell off up to $10 billion in assets, which would boost their earnings.

While holiday retail is important, the primary driver is the strong growth in AWS cloud sales. AI-driven demand has turned the cloud division into Amazon’s most significant profit engine.

Apple has potential today because of their AI advances and large revenue of $416 billion. Some predict the stock could reach $315, driven by excitement around foldable devices, and recent gains show positive movement.