- There has been a toning down of harsh tone in the trade rhetoric between the world's top two economies, favoring today's top stocks.

Daily stock performance predictions are very uncertain because markets can change quickly and without warning in the market. However, in a world currently dominated by AI hype and aviation boom, Nvidia, Broadcom, and Rolls Royce stocks aren’t just following trends, though. In this article, we discuss why these three stocks are likely to register near-term gains.

Nvidia Share price

By now it’s generally agreeable that Nvidia’s GPUs are the most important parts of everything from self-driving cars to generative AI. Last week, DA Davidson gave Nvidia stock a “Buy” rating of $210, and Bernstein raised theirs to $225. That implies that it could go up 20% from today’s $186.

CoinCodex’s algorithm scanned over 26 signals, and 24 of them returned positive results. That analysis means the price could be $218 by December. Why now? Q3 earnings reveal that cloud growth is over 40% year over year, thanks to Azure and Google, and Nvidia’s chips are central to that growth. The company’s 900% rise since the launch of ChatGPT shows that it can’t be stopped, despite all the noise from the market.

Recent reports reveal that U.S. markets went up after President Trump took a more conciliatory tone with China with a meeting with China’s Xi likely to happen. The meeting is set to focus on trade deals between the U.S. and China, and that’s good news for global tech and chip stocks like Nvidia (NASDAQ: NVDA).

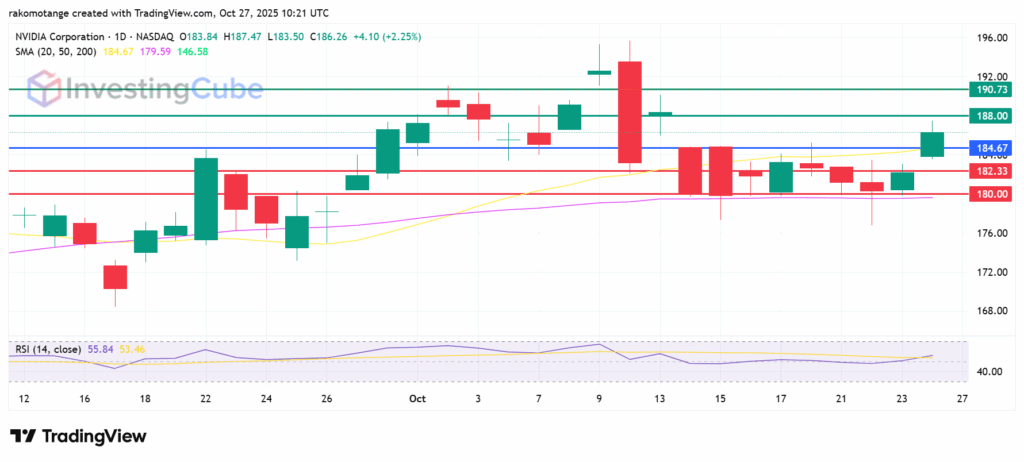

Nvidia Technical analysis

Nvidia stock price is at $186.26, and it is supported by its 20-day SMA at $184.67. Primary resistance is at $188, which is just above where the it recently hit highs. Buyers who want to buy on the dip might use the 50-day SMA key support level of $176.59 as a safety net.

The RSI at 55.83 is mostly neutral but leaning toward bullish, which means it has potential to rise without becoming overbought. With the stock staying above both the 20-day SMA, it is likely to stay on the upside trajectory, and potentially breach the $190 psychological barrier in the near-term.

Nvidia stock 1D chart. Source: TradingView

Broadcom Share Price

Broadcom (NASDAQ: AVGO), the AI orchestra’s unsung hero shares many similarities with Nvidia when it comes to fundamentals. Nvidia gets most of the attention, but AVGO’s customized processors and networking strength are what keep mega-data centers running. Broadcom’s revenue for the third quarter of FY2025 rose 22% to $15.95 billion, while AI sales soared 63% to $5.2 billion.

Mizuho just raised its target for Broadcom stock price to $400, attributed to AI tailwinds. In addition, 17 buy signals from TipRanks indicate “Strong Buy”, adding support to the positive outlook. Meanwhile, analysts at Barclays and KeyCorp have two of the highest bullish targets, at $450 and $460, respectively. This means there is a 29% to 32% upside on Broadcom stock price.

A new hyperscale contract for AI accelerators, valued at over $10 billion is in the works and could catalyse stronger gains. Broadcom is also in a good position to gain from the US-China trade talks’ conciliatory tone, especially as it has a lot of exposure to chips and AI infrastructure.

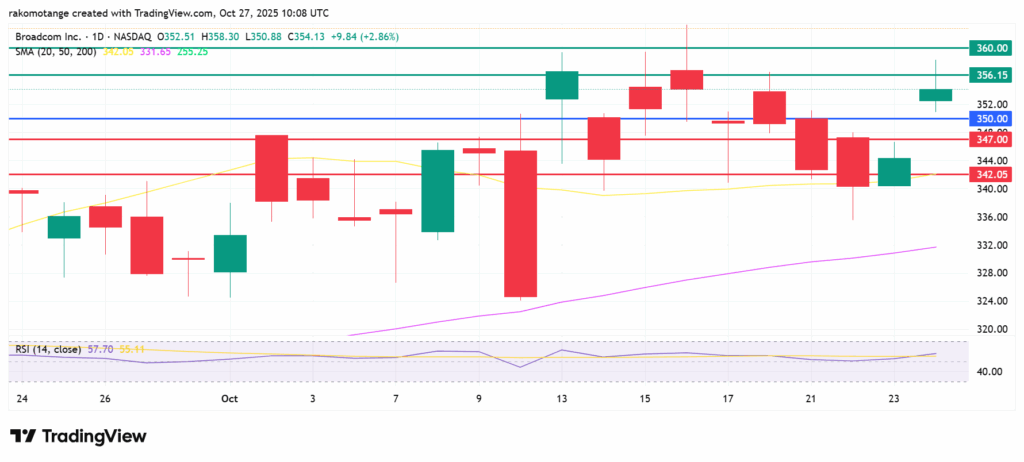

Broadcom Technical analysis

AVGO is at $354.13, which is well above its 20-day SMA of $342, and that is a positive sign. It faces immediate resistance at $356.24. A break above that level could potentially trigger positive sentiment to test $360. The RSI at 57.70, and rising the middle of the month, implies that buying will likely continue.

Its primary support is at the psychological $350 mark, and the next support is likely to come at $347. Breaching that support will invalidate the upside narrative and such momentum could potentially test $342.05 in extension.

Broadcom 1D chart. Source: TradingView

Rolls Royce Share price

Investors are concerned about the US-China tariff spat and the fact that demand for civil aviation is dropping in certain markets. This has caused a sell-off in growth stocks like Rolls Royce (LSE: RR.). But things might get better now that the trade tariff tone between China and the US has softened. Generally, travel is still going strong, and Rolls Royce’s civil aerospace unit is making money, thanks to defense contracts that add strength.

According to IATA, the civil aerospace division is doing well thanks to a 15% increase in flying hours, while defense contracts are adding to a £42 billion backlog. Also, Rolls Royce’s is manageable at £5.04 billion, with a debt-to-equity ratio of 206.94%, considering a free cash flow of £1.58 in the first half of 2025.

Meanwhile, the company’s transformation program’s goal of saving £500 million supports enhanced free cash flow estimate of £3.0-£3.1 billion for 2025. Also, at 11.12p, Q4 bookings and Boeing’s comeback might lead to improved sentiment, especially following GE Aerospace’s record profits last week. These factors could be a sign of good things to come in the sector.

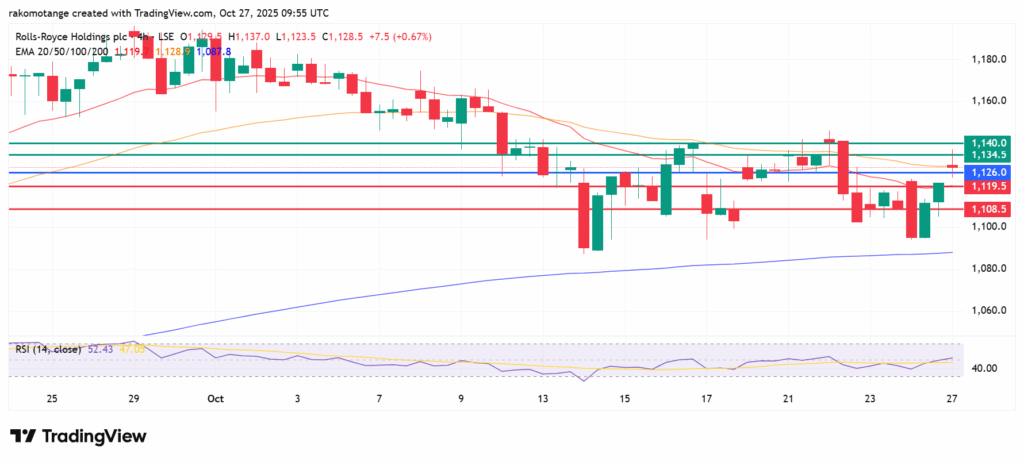

Rolls-Royce Technical Analysis

On the 4-hour chart, Rolls Royce share price pivot is at 1127p, and the RSI at 52 signals that it is likely to test primary resistance at 1,134.50p. A break above that level and with confirmation volume could clear the path to test 1,140p this week. On the downside, a weaker momentum could drive it lower to test the 20-period EMA of 1,119p, below which the upside narrative will be invalid. A stronger downward momentum could potentially test 1,108.5p.

Rolls Royce 4H chart. Source: TradingView

The company’s revenue is likely to keep rising due to strong demand from civil aerospace from increased flying hours and a similarly strong defense contract backlog.

The main risks are supply chain issues and potential economic slowdowns due to trade tariff barriers. However, strong fundamentals and earnings growth will likely provide a buffer.

Analysts maintain a “Strong Buy” consensus. Generally, its average price target implies significant upside, driven by AI demand and earnings growth.

Broadcom supplies critical networking and connectivity chips that power AI servers. That has positioned it as a key beneficiary of accelerated AI infrastructure spending