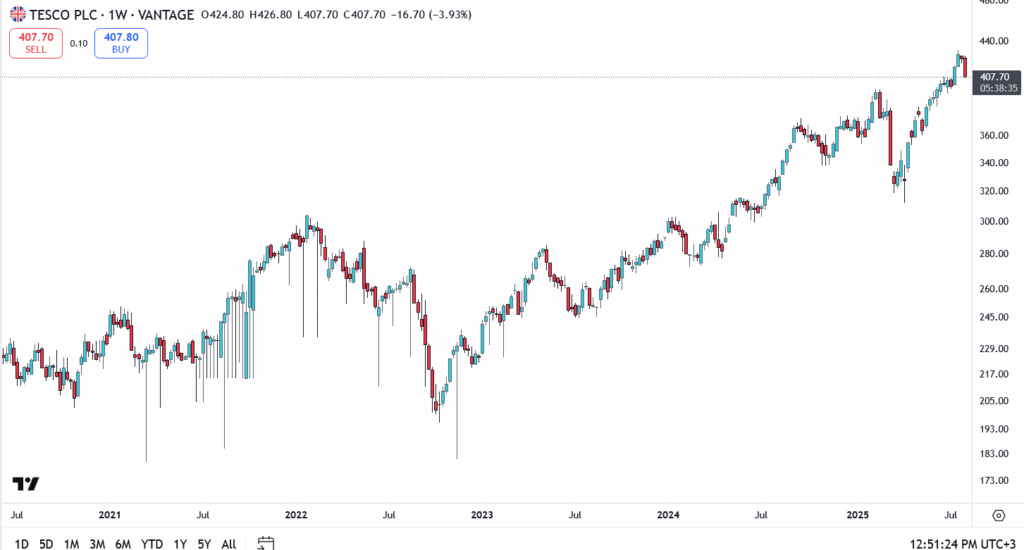

Tesco’s (LON: TSCO) share price fell 3.93% to 407.70 in early Friday trading, snapping its recent winning streak after hitting a fresh multi-year peak above 426 earlier this week. The drop comes as traders lock in profits from a strong summer rally, with the weekly chart showing the supermarket giant losing momentum near the upper end of its 2025 uptrend channel.

From Rally to Resistance

After a steady climb from January’s sub-330 levels, Tesco’s stock broke through key resistance in June and extended gains into early August. However, today’s drop shows the £426–£430 area is proving tough to crack, with sellers stepping in quickly once the stock reached that range. Even so, the price is still comfortably above key moving averages, which means the overall uptrend hasn’t been broken yet.

Viral Tesco Birthday Cake Sandwich Creates Buzz

Tesco is trending for its anniversary special, a limited-edition “birthday cake sandwich.” The unusual creation has stirred mixed reactions online, with some shoppers intrigued and others less impressed. Still, the buzz has put Tesco firmly in the spotlight, giving it a timely boost in brand visibility as UK retailers battle to keep customers engaged in a softer spending climate.

Tesco Technical Levels to Watch

- Current price: 407.70

- Resistance: 426.00, then 440.00

- Support: 402.50, followed by 392.00

Outlook: Testing the Bulls’ Nerve

Today’s decline looks more like a healthy breather than a trend reversal, but traders will be watching closely for follow-through selling next week. Strong buying interest above 400 would reinforce the bull case, while fading momentum could leave Tesco vulnerable to a retest of July’s breakout levels.