Tata Steel has been quietly reshaping how it uses capital, and it’s starting to show in the numbers. Over the last five years, the company’s Return on Capital Employed (ROCE) has climbed sharply even though the capital base has stayed largely flat.

ROCE, which measures how much profit a business earns from the capital it uses, has moved up to 7.8% over the past twelve months (₹150 billion EBIT on a base of about ₹1.9 trillion). That’s still below the broader metals industry average of 13%, but the trajectory matters more than the headline number right now.

This lift in returns without piling on more capital signals stronger asset utilisation and tighter operational discipline, exactly the kind of shift that often sits at the heart of multi-bagger stories.

Five-Year ROCE Trend Shows Real Progress

The figures are clear: ROCE has risen 331% in five years, while capital employed has stayed roughly the same. That means Tata Steel is now generating far more profit from each rupee already tied up in the business.

Instead of chasing volume growth or adding heavy new capacity at the expense of returns, the company has focused on sweating its existing assets harder. This is the type of compounding pattern long-term investors look for, reinvesting profits where they produce more, not just bigger, numbers.

Expansion Signals Long-Term Confidence

This efficiency drive hasn’t slowed growth plans. On September 12, SRF Limited signed an MoU with Tata Steel Special Economic Zone Limited (TSSEZL) to acquire land worth ₹282 crore in Gopalpur, Odisha.

While the project itself will be run by SRF, the deal reflects growing interest from large manufacturers in setting up inside Tata Steel’s industrial zones. That external demand strengthens the case for Tata Steel’s long-term vision, building out an integrated ecosystem while keeping its own balance sheet lean.

At the same time, the company is investing in modernising its plants and transitioning parts of its network to low-carbon steelmaking, positioning it well for the shift in global demand patterns.

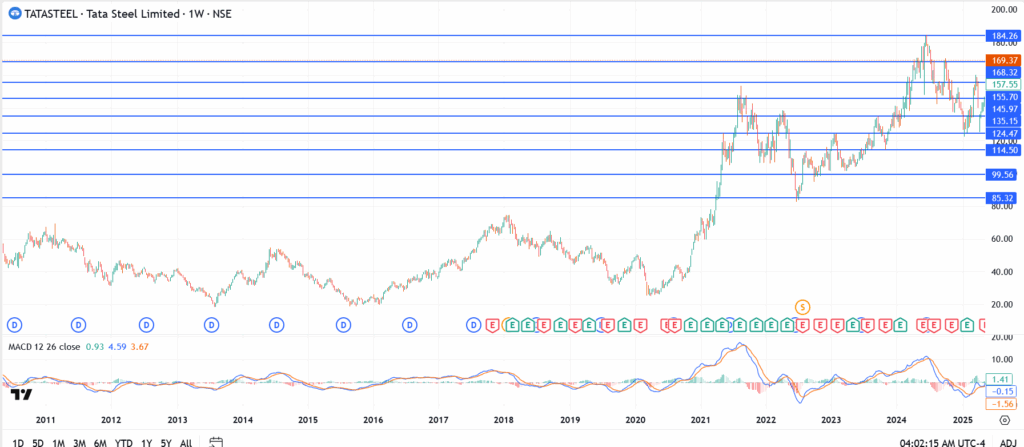

Tata Steel Chart Analysis Today

- Current price: ₹169.37

- Support: Key support sits near ₹155. Below that, deeper support is visible at ₹146 and ₹135.

- Resistance: The main resistance is at ₹184, a level that capped the last rally attempt.

Trade entry: Short-term traders may watch for pullbacks into the ₹155-₹158 range as potential entry points if support holds. A break below ₹155 would tilt risk toward ₹146.

Tata Steel Stock Outlook

Tata Steel has moved off the ₹155 base with improving momentum, just as the fundamentals are showing signs of compounding strength. If it holds this support while ROCE keeps climbing, the stock could attempt a push back into the ₹180-₹185 zone over the coming months.

With rising efficiency, measured expansion, and a stronger balance between growth and returns, Tata Steel is shifting from a cyclical trade into a steady compounded 1, and that change is exactly what the market has started to price in.

ROCE stands at about 7.8% based on the trailing twelve months to June 2025, showing clear improvement from past levels.

Tata Steel is modernising plants, scaling low-carbon steelmaking, and expanding its industrial ecosystem through zones like Tata Steel Special Economic Zone Limited, which recently signed a ₹282 crore land MoU with SRF Limited.

TATASTEEL is trading near ₹169 with support at ₹155 and resistance around ₹184. If the current momentum holds, it could attempt a move back toward the ₹180-₹185 zone.