Tata Steel shares jumped sharply today after the company laid out a fresh ₹17,500 crore investment roadmap. Most of that money is heading into its Indian operations, which, judging by market reaction, is exactly what traders wanted to hear.

The stock rose more than 4.8% intraday, brushing past recent resistance levels as buyers came in heavy post-earnings. The sentiment? Steel might be dull right now, but Tata’s playing the long game.

What’s Driving Tata Steel Right Now?

This isn’t just a capex update it’s a tone shift.

The company revealed that ₹11,000 crore out of the total will go into domestic growth. That covers everything from Kalinganagar upgrades to newer volume initiatives. The UK and Netherlands will get smaller slices enough to keep the green steel transition alive without draining resources.

The earnings themselves? Mixed bag. Revenue slipped over 4% YoY to ₹56,218 crore, dragged by soft steel prices. But profits jumped to ₹1,200 crore more than double last year’s Q4. The reason? Falling coking coal costs and better volume handling. Margins are stabilising.

Nuvama liked what it saw. The brokerage firm pushed its price target to ₹177 and slapped on a ‘Buy’ rating, citing improving cost dynamics and a decent European turnaround plan.

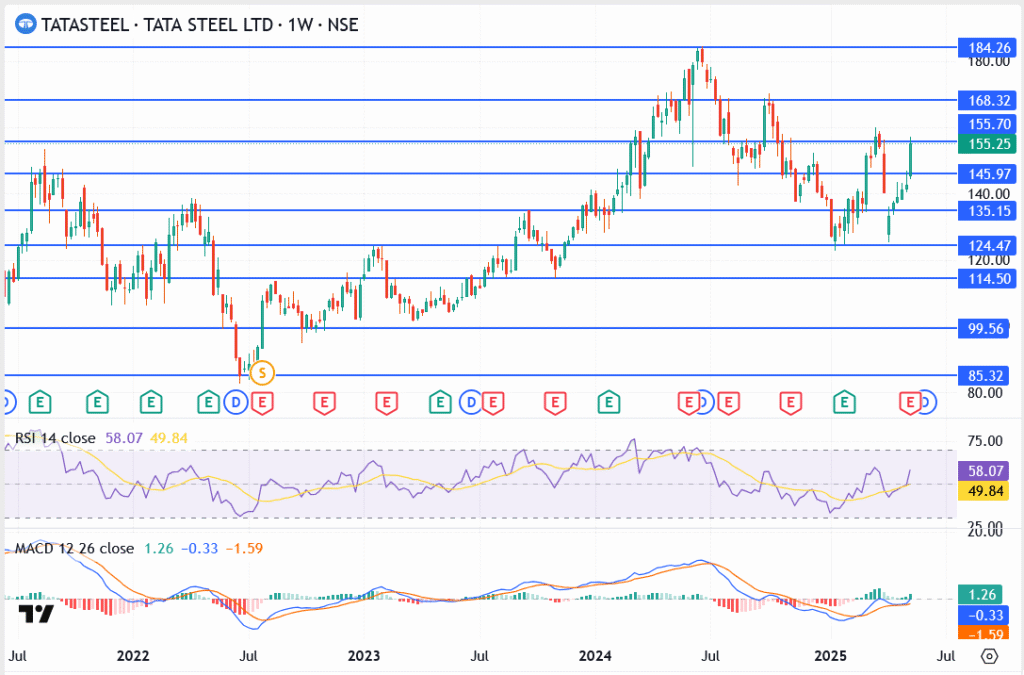

Tata Steel Share Price Chart: Key Levels to Watch

- ₹135.15 was the line in the sand — and it held

- ₹145.97 got taken out clean — that’s now support

- ₹155.70 is acting sticky — price needs to close above it

- ₹168.32 is the next wall if bulls stay in charge

- RSI hovering just under 60 — shows strength, but not overheated

- MACD is green — momentum’s on the table

In plain terms: this rally has legs if it can hold above ₹155. A close below ₹145, though? That would cool things off fast.

The chart shows a clean upside structure with scope for continuation. If ₹155.70 holds, momentum could push toward ₹168–₹184 in the coming weeks.

Outlook

Realizations are expected to rise ₹3,000 per tonne next quarter. Add that to another $10 drop in coking coal prices and you’ve got a recipe for margin expansion.

Nuvama says Kalinganagar alone could drive 8% India volume growth through FY27. Europe? Expected to break even in the UK by Q2 FY26. Netherlands might lead the rebound as early as Q1.

If even half of that plays out, we’re looking at 31% EBITDA CAGR over two years. That’s not a small shift and it might explain why traders are suddenly paying attention.