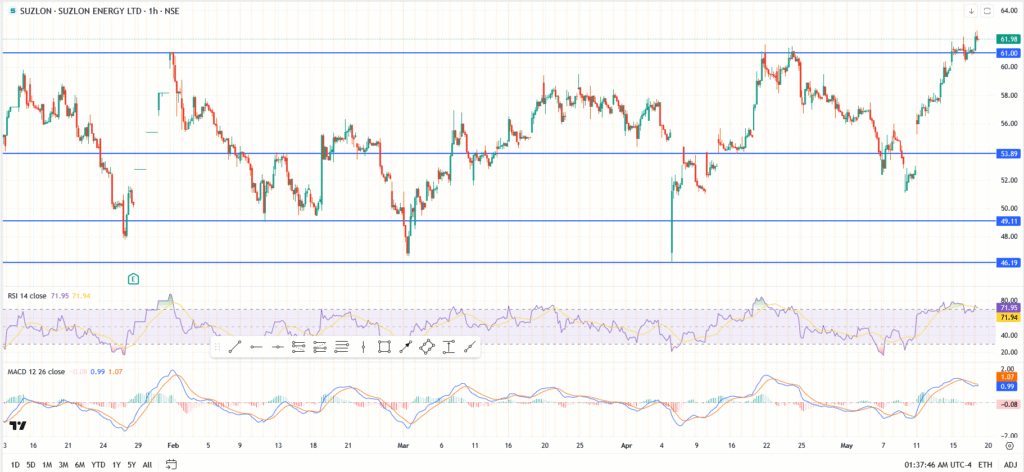

Suzlon Energy just crossed back above the ₹61 mark, and it’s catching attention again. The stock opened strong on Monday, building on two weeks of steady gains. It’s not just a quiet push either. Suzlon has come up fast from the ₹53 zone, and the way it’s moving now, traders are wondering if ₹64 might be next on the radar.

After a messy April, this is the cleanest breakout Suzlon has seen in a while. Buyers are back, volumes are picking up, and the chart is showing strength. What’s more, it’s happening right as India’s power and renewable sectors come back into focus, not a coincidence.

So, What’s Pushing Suzlon Higher?

It’s not one thing; it’s a mix. Momentum came in after the ₹61 ceiling gave way. That level has capped prices twice before, but this time, it broke. The rally started earlier this month when Suzlon bounced off the ₹53 level, and it hasn’t looked back much since.

A few things traders are pointing at:

• Energy stocks are hot, especially the clean power names

• ₹61 was big — now that it’s cleared, bulls are back in control

• RSI is in overbought territory (above 71), but no sell signals yet

• MACD is still bullish, though it’s beginning to flatten a bit

• No real signs of profit-taking yet, which says confidence is holding

What to Look For This Week

• Support: ₹61 — needs to hold if this breakout is going to stick

• Next test: ₹64 — last time Suzlon hit that zone, it got smacked back

• If it clears ₹64: blue sky ahead until ₹68

• Breakdown risk: ₹53.89 — that’s the last solid support below

Momentum looks strong for now, but the stock is stretched. RSI sitting above 70 means it’s been a hot run short-term cool-off wouldn’t be a surprise. Still, price action isn’t showing weakness yet.

Conclusion

Suzlon has had a solid May so far. The breakout above ₹61 was clean, and bulls are still driving. Unless we see a sharp reversal, this move has legs. Keep an eye on ₹64, it’s the level that could either spark a pause or open the door to more upside. Either way, Suzlon is back in motion, and the tape is telling a bullish story.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.