Suzlon Energy (NSE: SUZLON) isn’t attracting much buying interest this week. The stock was last spotted around ₹64.10, just below that important ₹65.70 area where bulls had tried holding ground. It’s not a collapse, but momentum has clearly dried up. And after the sharp climb in April and May, this feels more like the market stepping off the gas than any sudden change in direction.

So far, the drop looks technical. There’s no fresh headline. No new downgrade. And no bad numbers either. Suzlon’s full-year numbers are still holding up: ₹10,871 crore in revenue for FY2025 and ₹2,072 crore in profits, both big jumps from the year before.

Why Suzlon Energy Share Price Is Losing Steam This Week

This isn’t panic selling, it feels more like fatigue. Traders who rode the big move from March lows are probably trimming. The broader market has taken a cautious tone this week, and Suzlon’s own rally was intense, with the stock climbing over 50% in just two months. Even bulls would admit it was due for a breather. On top of that, last week’s downgrade from Geojit didn’t help sentiment. Yes, the target was raised to ₹77, but the call shifted from ‘Buy’ to ‘Accumulate,’ which sends a mixed message. It’s the kind of thing that tends to put short-term traders on pause.

Suzlon Share Price Chart

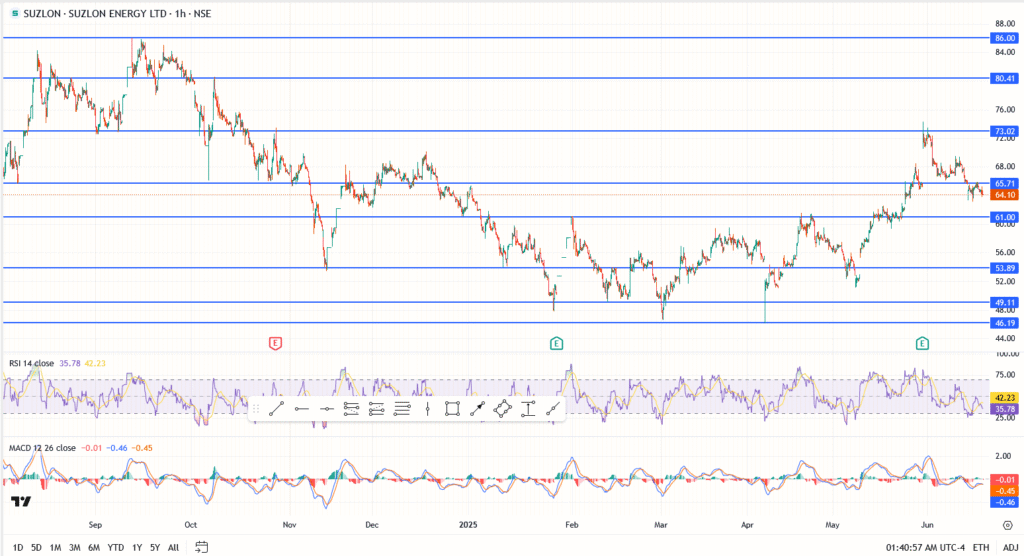

- Current price: ₹64.10

- First resistance: ₹65.70

- Next resistance zones: ₹67.70, then ₹69.70

- Immediate support: ₹62.25

- Deeper support: ₹59.90

- RSI: 42 — sideways bias

- MACD: still showing downside pressure

So far, buyers haven’t shown up in force. And as long as we stay stuck below ₹65.70, the edge tilts toward sellers.

Suzlon Share Price Outlook: Healthy Fundamentals, But Momentum Lacking

There’s no need to panic not if you’re holding Suzlon Energy (NSE: SUZLON) with a long-term view. The company’s fundamentals are still intact. Debt is nearly cleared, free cash flow is solid, and its 5.6 GW order book positions it well ahead of the new RLMM local content mandate.

What we’re seeing now looks more like a reset than a reversal. But price action needs to confirm it. Unless bulls can reclaim ₹65.70 with conviction, the stock will likely remain stuck in a tight range. A drop below ₹62.25 would flip the tone bearish in the short term.

For now, Suzlon’s share price is cooling not collapsing. The fundamentals haven’t changed, but the momentum clearly has. And until traders see a new catalyst, this pause may continue.