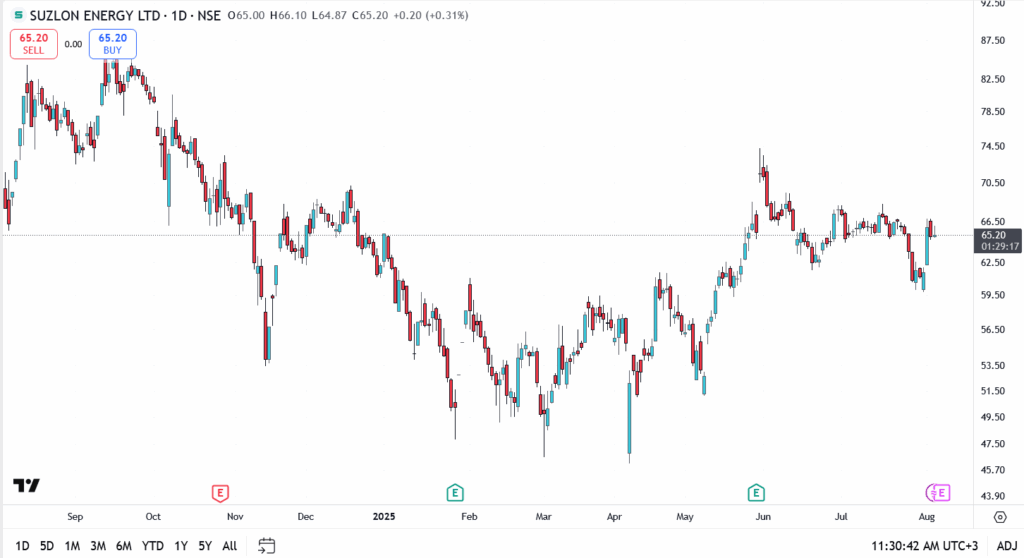

Suzlon Energy shares are back on firmer ground, rising to ₹65.20 on Tuesday as the stock recovers from last week’s brief sell-off. After sliding below ₹60 in early August, Suzlon has quickly regained investor interest, fueled by improving sentiment across the renewables sector and follow-through buying from last week’s 381 MW project win.

The bounce couldn’t have come at a better time. Suzlon had been drifting in a tight range for days, with the post-Zelestra order excitement fading and short-term traders heading for the exits. But as the stock approached ₹60, buyers stepped back in, and the recovery since then has been steady.

The shift also mirrors what’s happening across the broader energy space. Domestic funds have started rotating back into power stocks, positioning ahead of FY26 capex plans. Suzlon’s steady pipeline of utility-scale wind projects puts it in a strong spot as capital spending on renewables picks up pace.

Suzlon Share Price Outlook

- Current price: ₹65.20

- Resistance: ₹66.50 and ₹67.70

- Support: ₹62.00, then ₹58.50

The stock is once again testing the upper end of its consolidation zone, just shy of the ₹67.70 ceiling that capped the rally last month.

Conclusion

Suzlon isn’t just bouncing, it’s holding ground where it matters. After last week’s flush-out, the stock has snapped back with intent, and the price action suggests buyers aren’t done yet. The clean energy theme remains hot, fund flows are shifting back, and Suzlon’s order book is doing the talking.

As long as ₹62 holds, bulls have room to play. A push through ₹67.70 could flip the script and set the stage for a move toward ₹70-plus. The next few sessions will tell us if this is just a relief rally or the start of something big