- Suzlon stock trades at ₹56.35 . Will SUZLON finally break ₹61 resistance or roll back to ₹49? Chart signals and 2025 drivers inside.

Suzlon Energy Ltd (NSE: SUZLON) is stuck in a sideways chop, with bulls failing to break higher and sellers unwilling to press lower. The market isn’t giving it much breathing room, but that might not last much longer.

Suzlon Chart Setup: Bulls and Bears in a Standoff

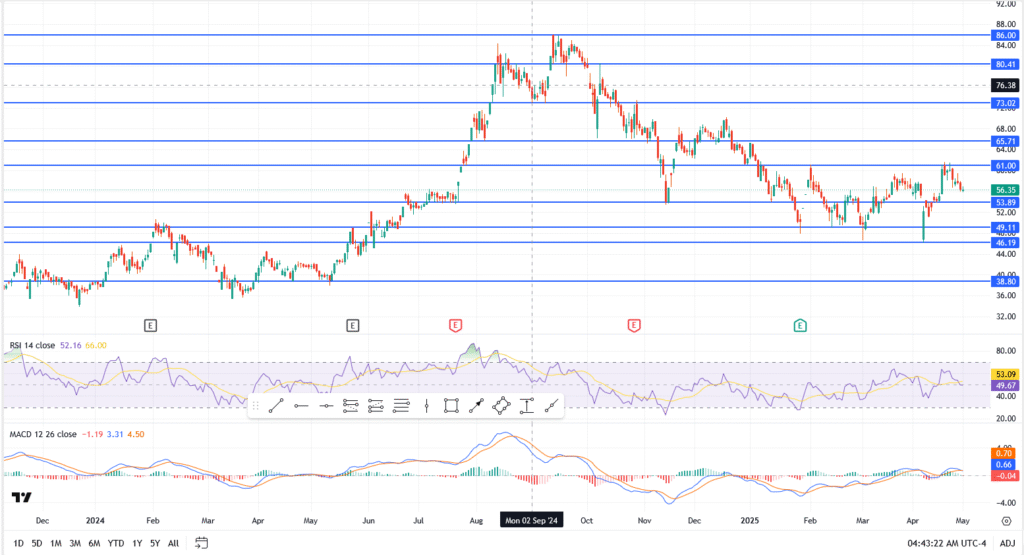

The chart has clear battle lines. On the upside, ₹61 is acting like a lid — it’s capped every breakout attempt for the past three weeks. Flip that level convincingly, and ₹65.71 comes into view, followed by the bigger target at ₹73.02.

On the downside, ₹53.89 is the first line of support. Lose that, and we’re looking at a pullback toward ₹49.11 or even ₹46.19. The MACD is soft, and RSI’s drifting. There is no urgency from either side yet.

- Current Price: ₹56.35

- Resistance: ₹61.00, ₹65.71, ₹73.02

- Support: ₹53.89, ₹49.11, ₹46.19

- RSI: 52.16 — coasting near neutral

- MACD: Weak crossover, no follow-through

Until ₹61 gives way, this chart is just noise.

Is Suzlon a Good Stock to Buy in 2025?

- Energy policy tailwinds – New wind power bids and renewable targets out of New Delhi have given Suzlon some tailwind, but it’s not translating into price just yet.

- Balance sheet cleanup – The debt story that used to haunt Suzlon is slowly fading. It’s not spotless, but leverage is down, repayments are up, and the bleeding has stopped.

- Back-to-back profits – Four straight profitable quarters, not flashy, but it’s a clean turnaround compared to a few years back. Margins are holding up, and costs are tighter.

- Mid-cap fatigue – This isn’t about Suzlon alone. Mid-cap energy names have cooled across the board. Traders want confirmation before they commit fresh capital.

May Forecast: Coiled Spring or More Chop?

Right now, Suzlon’s sitting in no-man’s land. A close above ₹61 could get things moving, but without volume, it’s just another fakeout waiting to happen.

On the flip side, if the stock slips under ₹53.89, it opens the door to a deeper fade toward ₹49. Either way, May probably won’t stay quiet.

Final Take: Buy the Breakout, Not the Hype

The story has improved. Suzlon isn’t bleeding cash, it’s not buried in debt, and India still wants more wind power. But the stock needs a push.

If you’re looking to enter, wait for a real breakout, not just a couple of green candles. ₹61 is the level that matters. Until then, it’s a patience game.