Suzlon Energy has officially become debt-free and posted a ₹1,181 crore profit in Q4 FY25, yet the stock has barely moved. Instead of rallying, Suzlon shares are stuck near ₹65.45, struggling to break above resistance even as bullish headlines stack up.

The muted response suggests that the good news may already be priced in, or that investors are waiting for more clarity before pushing the stock higher.

Suzlon Energy Becomes Debt-Free, Gets Merger Nod

On July 6, Suzlon confirmed the complete clearance of its debt, a major turning point in its multi-year recovery. The company also posted stellar quarterly earnings, with ₹1,181 crore in net profit for Q4 FY25, driven by margin expansion and operational efficiency.

Adding to the momentum, Suzlon Global Services and Suzlon Energy received a ‘no adverse observation’ notice from both the BSE and NSE regarding their merger proposal. While the consolidation sets the stage for operational streamlining, markets have so far reacted cautiously.

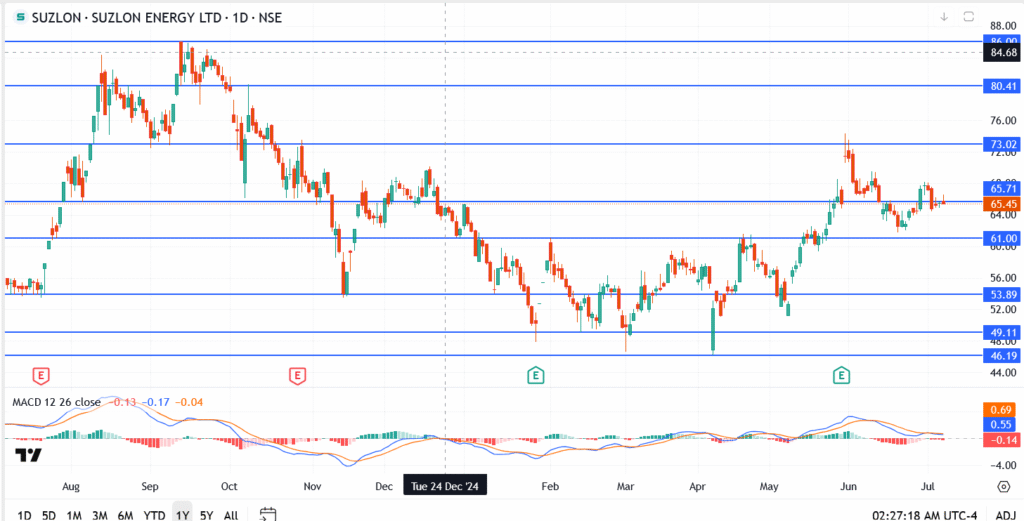

Suzlon Energy Share Price Analysis

- Current Price: ₹65.45

- Resistance Zones: ₹65.71 and ₹73.02

- Support Levels: ₹64.00, then ₹61.00

- MACD: Bearish crossover; momentum slowing

- Price Action: Fading rallies and narrow consolidation

Outlook

Becoming debt-free and posting ₹1,181 crore in profits should have lit a fire under Suzlon’s stock, but the market isn’t biting yet. The price action feels cautious, almost like traders are stepping back after last year’s massive 300% run.

₹64 remains a critical line in the sand. As long as buyers defend it, the uptrend holds. But if it slips, things could unravel fast. For now, Suzlon is caught between strong fundamentals and a market that isn’t quite ready to chase the story.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.