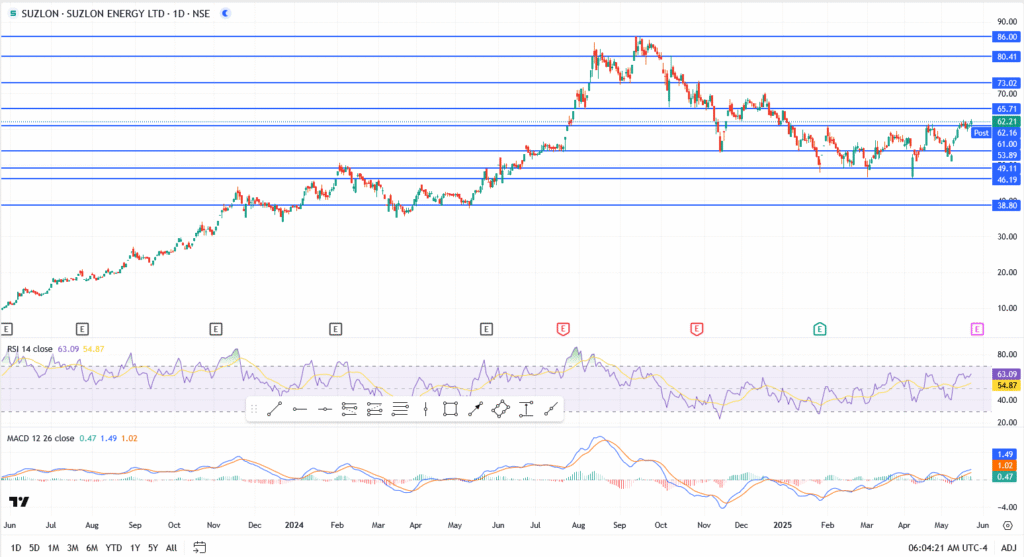

Suzlon Energy is showing signs of life again. After weeks of range-bound price action, the stock has pushed back above ₹62, a level it last tested in early April. Momentum is firming up, but so is overhead resistance. The ₹65 zone has been a magnet for sellers for months, and traders are watching to see if this rally can finally punch through.

At the time of writing, Suzlon is trading at ₹62.21, up modestly on the day and holding gains from Wednesday’s late-session bounce.

Suzlon Energy Share Price: Chart Breakdown

- Resistance holding near ₹63, which has capped upside attempts multiple times this month

- Support firm at ₹58.20, a level buyers defended during the last pullback

- Price consolidating above ₹60, forming a tight range — typical before earnings releases

- If ₹63 breaks post-results, next key resistance sits around ₹68.50 (May 2023 swing high)

- A drop below ₹58.20 could trigger a slide toward ₹55.30, where previous accumulation occurred

Market chatter suggests Suzlon is likely to post a net profit close to ₹254 crore for the March quarter. That’s lower than what it pulled in a year ago, down about 21 percent. Not necessarily a red flag, the drop is mostly because of one-off adjustments, but it’s still a slowdown.

Revenue, on the other hand, should land around ₹2,179 crore. That’s steady, not spectacular. Investors are likely to zoom in on margins, given rising costs and how stretched the company’s order execution pipeline might be getting.

There hasn’t been a dividend from Suzlon since 2008, and that’s become a sticking point for many long-term shareholders. During the last earnings call, management hinted that a payout could be on the table later this year — but only after a key internal restructuring wraps up, likely around July. Until then, it’s wait and see.

As of this week, Suzlon’s share price is sitting at ₹61. That’s up 32 percent over the past year and more than five times higher than where it traded two years ago. It’s been one of the market’s renewable energy darlings, but those kinds of gains come with pressure.

A lot of the optimism is baked in now. For the rally to continue, Suzlon will need to show it can keep momentum going without leaning on sentiment alone.