- Starbucks is embarking on a $1 billion restructuring, closing underperforming stores and reshaping its North America portfolio.

Starbucks Restructuring: What’s Happening Now

Starbucks Corporation (NASDAQ: SBUX) said earlier today it’s closing hundreds of U.S. and Canadian stores and laying off 900 non-retail employees as it focuses more of its resources on a turnaround. The move, estimated to cost about $1 billion, will mainly impact North America, where 90% of the charges will be recognized in fiscal 2025.

Each year, we open and close coffeehouses for a variety of reasons, from financial performance to lease expirations. This is a more significant action that we understand will impact partners and customers. Our coffeehouses are centers of the community, and closing any location is difficult.

Said Brian Niccol In a letter sent to employees

China Stake Sale Could Be the Real Game-Changer

The closures in North America have stolen headlines, but the more transformative play could come from China. Starbucks has invited bids from global investors, including Carlyle, EQT, and Tencent, for a controlling stake in its China business, valued at up to $5 billion.

At the same time, Starbucks is making moves at home to steady its foundation. Alongside the restructuring, management announced a 2% pay rise for salaried staff in North America. That decision softens the blow of layoffs and signals the company isn’t just cutting costs but reshaping its workforce for efficiency and long-term stability.

Starbucks Share Price Today: Key Levels to Watch

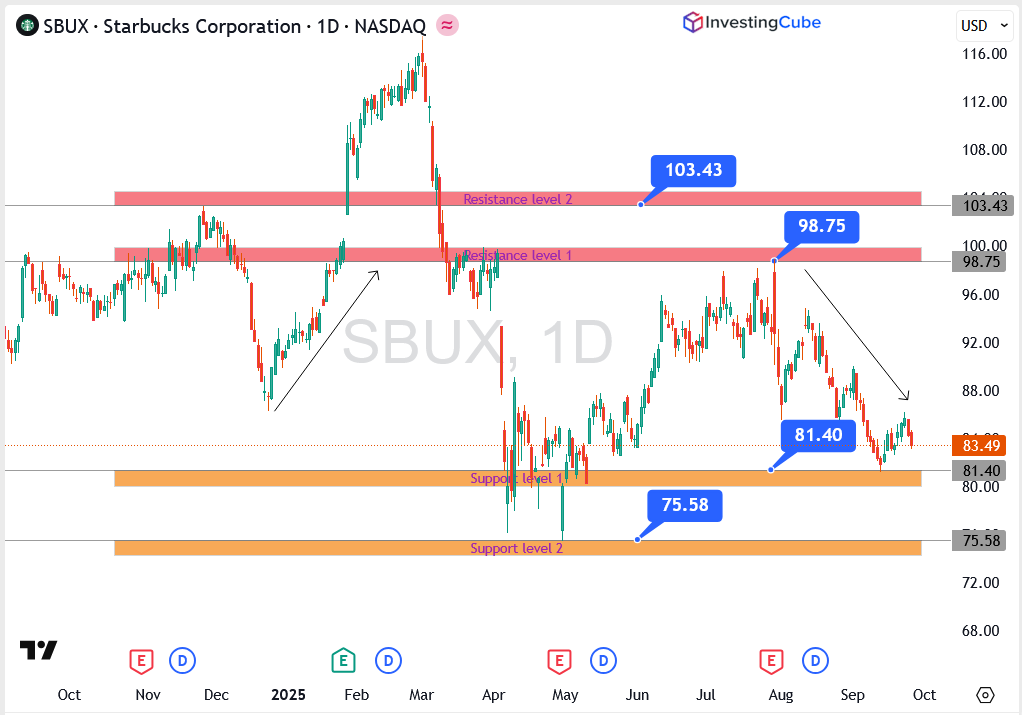

Starbucks shares closed Thursday at $83.49, down 1.18% on the day as markets processed the restructuring news.

- Support zone: $81.40 (short-term cushion) and $75.58 (major floor if selling deepens).

- Resistance zone: $98.75 (first ceiling) and $103.43 (stronger upside barrier).

If Starbucks can defend the $81.40 level, the stock has room to steady and stage a recovery. Slip under $75.58, though, and the tone turns bearish quickly. For momentum to swing back to the bulls, a clean push through $98.75 is the key test.

Closing Take: Reset, Not Retreat

Restructuring stories are never comfortable, but for Starbucks, this looks more like a strategic reset than a collapse. The mix of store closures, salary hikes, and a possible China stake sale shows management is balancing short-term pain with long-term positioning.

Yes, stock volatility is likely in the weeks ahead. But combine the $1 billion restructuring with a multibillion-dollar China deal and a growing push into digital channels, and Starbucks could emerge with a stronger foundation than it has today.

Starbucks FAQs

Starbucks is shutting underperforming stores that don’t meet brand or financial criteria, as part of a broader $1 billion restructuring plan.

Roughly 900 roles will be cut, but the company is also raising salaries by 2% for salaried employees in North America.

It’s a 50/50 call. On one hand, the restructuring, China stake sale, and analyst upgrades could set the stage for recovery. On the other, near-term costs, debt, and global competition mean the risks are just as real. Investors need to weigh both sides carefully.