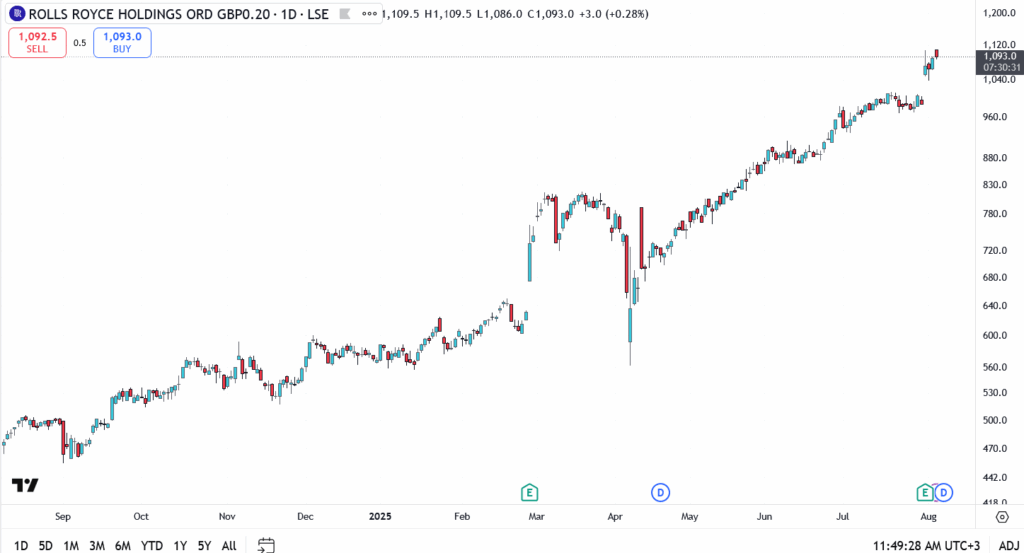

Rolls-Royce shares punched through fresh record highs on Tuesday, crossing £1,109.5 intraday before settling just above £1,093. The move caps off an explosive run for the stock, which has now rallied more than 35% in under two months as investors pile into aerospace and defense names.

The move marks a fresh breakout in what’s already been one of the FTSE 100’s most impressive rallies of 2025. Up over 35% since June, Rolls-Royce is no longer just a turnaround story, it’s turning into a momentum trade backed by real fundamentals.

Jefferies recently raised its share price target, citing continued strength in the civil aerospace segment and defense orders from European and Middle Eastern partners. Meanwhile, fresh filings show that U.S.-based L&S Advisors initiated a new position in the stock, adding to signs of international confidence.

Rolls-Royce Share Price Outlook

- Current price: £1,093.0

- Resistance: £1,120.0

- Support: £1,045.0, then £985.0

The price action tells its own story. Rolls-Royce has cleared previous highs with volume, posting consecutive green candles as bulls tighten their grip. If it can hold above the £1,045–1,060 zone, the next target sits at £1,120, which also marks the psychological upper band of this rally leg. On the downside, £985 remains the key pivot from the last consolidation phase.

Conclusion

Rolls-Royce’s chart is doing exactly what investors want to see: higher highs, strong closes, and rising institutional participation. With the defense sector heating up and global air travel demand stabilizing, the stock’s momentum has strong macro backing.

If the current trend holds, Rolls-Royce could be setting up for a push toward £1,200 in the coming weeks. For now, bulls remain firmly in control, and they finally have both fundamentals and fund flows on their side.