- Rolls Royce share price holds above 733p as bulls eye 816p. Can RR. stock extend gains on SMR momentum and defense deals?

Rolls-Royce (LSE: RR..) is trading just above 733p this week, finding support after a sharp pullback in early April. It’s hovering around 742p, a level that’s drawing close attention from traders watching for a breakout or a reversal.

Government Deals and SMR Plans Keep Bulls Interested

Investor focus remains on the long-term contract Rolls-Royce secured with the UK government to supply nuclear reactor tech for submarines — an £9 billion, eight-year deal that underpins future revenue. The firm is also positioning itself in the SMR (Small Modular Reactor) space, with regulatory movement expected in the coming months.

The global SMR market is projected to cross $70 billion by 2033, and RR. is hoping to carve out a serious slice. Investors are already starting to price that into the story.

On the commercial side, engine demand has picked up as airlines push capacity back to pre-COVID levels.

RR. Stock Technical Outlook: Key Levels in Play

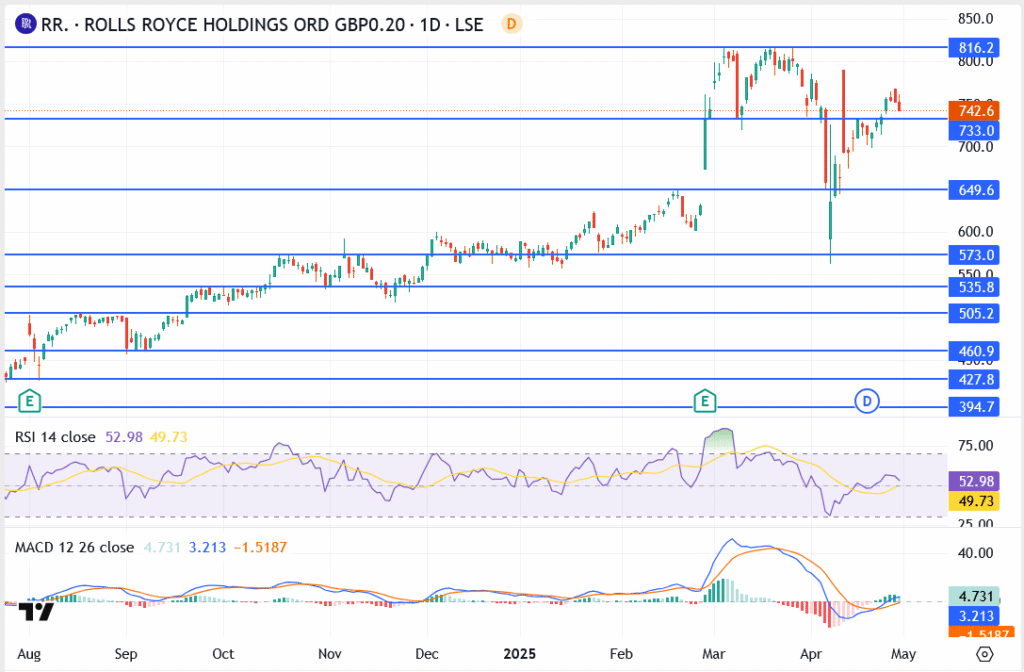

The share price is currently pivoting near 733p. Holding above this zone keeps the path open for a retest of 742.6p. If that breaks, the next upside target is 816p, the 2025 high.

But if buyers lose control and the stock slips under 733p, it opens the door toward 649.6p support. Below that, the next key floors are around 573p and 535.8p.

- Resistance: 742.6p, then 816.2p

- Support: 733p (pivot), 649.6p, 573p, 535.8p

- RSI: Neutral at 52.98, slight upward tilt

- MACD: Positive crossover building momentum

Outlook: Can Rolls-Royce Stay in Rally Mode?

There’s still upside potential, if the chart holds. Traders are watching whether the 742–750p range gets cleared with conviction. News on SMRs or fresh aviation orders could provide the next spark.

For now, the trend remains bullish above 733p. A strong push above resistance could revive the rally back toward the March highs.