Persistent Systems (NSE: PERSISTENT) got no love from the market on Friday, tumbling over 7% to ₹5,150 despite reporting a 19% jump in revenue for the June quarter. The numbers were solid on the surface, but traders didn’t bite, and the selling came fast.

Q1 revenue rose to ₹2,422.5 crore, up from ₹2,033.3 crore a year earlier. Net profit stood at ₹298.5 crore, showing a 10% rise YoY. But the market wasn’t just looking for growth, it wanted momentum. And that’s where things fell flat.

What Spooked the Market?

The quarter-on-quarter growth slowed to 2.7%, and that’s what did the damage. Expectations were sky-high after Persistent reaffirmed its ambitious $2 billion target by FY27. But without a fresh upgrade or bullish surprises, investors took profit, fast.

Margins stayed mostly flat, and management sounded cautious on near-term deal conversions. That didn’t help sentiment, especially in a week where mid-cap IT stocks were already showing cracks. Large funds trimmed positions, and once the selling began, technical stops were hit.

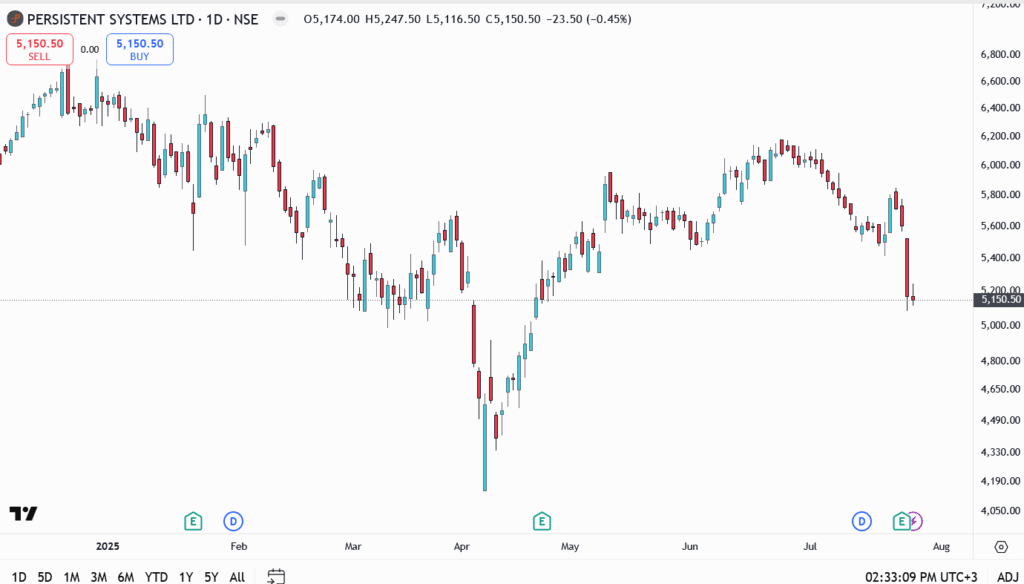

Persistent Systems Share Price Chart Analysis

- Current price: ₹5,150.50

- Resistance: ₹5,290 and ₹5,470

- Support: ₹5,115, then ₹4,940

- Price sliced below ₹5,290 – key trendline support broken

- Today’s low around ₹5,116 suggests bears are in control

- RSI has rolled over – momentum is fading fast

Outlook: More Pain or a Buy-the-Dip Setup?

Persistent isn’t a broken story, far from it. The long-term ambition remains intact, and its deal pipeline is solid. But in this market, strong isn’t always enough. Without upside surprises or margin expansion, the bar just feels higher.

For traders, ₹5,100 is the make-or-break line. If it cracks, ₹4,940 comes into view. Bulls need to push the price back above ₹5,290 to flip the short-term script. Until then, it’s a chart dominated by sellers.