Persimmon’s stock retreated in early Wednesday trading, even after the UK homebuilder delivered first-half earnings that exceeded analyst expectations. Shares fell around 3% to the 1,075p area as the market weighed stronger volumes against a softer margin outlook.

Earnings Beat, Volume Growth, and a Bigger Order Book

In the first six months of the year, Persimmon completed 4,605 homes, up 4% from the same period in 2024. Revenue climbed 14% to £1.50 billion, while underlying pre-tax profit reached £164.9 million, beating consensus estimates.

Margins held at 13.1%, reflect cost control in a challenging market. The forward order book rose to £1.25 billion, up 11% year-on-year, with the average private selling price increasing to roughly £292,800.

Management reaffirmed its 2025 guidance of 11,000–11,500 home completions and raised its 2026 target to around 12,000. However, executives signalled that margin growth in both years will be constrained by rising build costs and ongoing affordability pressures in the UK housing market.

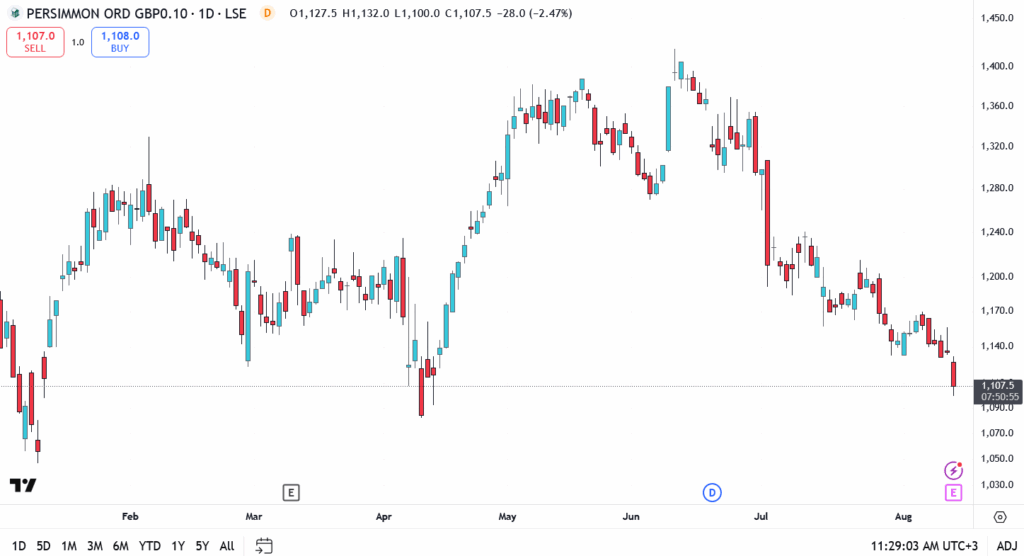

Chart Analysis

- Current price: ~1,075p

- Immediate resistance: ~1,120p, a level that has capped rebounds since early August

- Support levels: ~1,050p, then ~1,030p if selling accelerates

Persimmon’s chart remains in a short-term downtrend from the June peak near 1,400p. Wednesday’s decline kept the stock below its 20-day moving average, underscoring the need for a decisive break above 1,120p to turn sentiment. Failure to hold 1,050p could invite another test of the summer lows.

Market Reaction: Caution Over Margins Outweighs Solid Delivery

While the top-line numbers were stronger than expected, traders appear more concerned about the margin outlook than impressed by the volume gains. For a sector reliant on both demand and cost efficiency, the combination of high inflation in construction materials and a subdued first-time buyer market remains a significant headwind.

Institutional investors will be watching the next two quarters to see whether Persimmon can counter rising costs through tighter pricing and sharper operational execution. The company’s ability to execute on its raised 2026 target will determine whether this week’s pullback becomes a buying opportunity or the start of a deeper retracement.