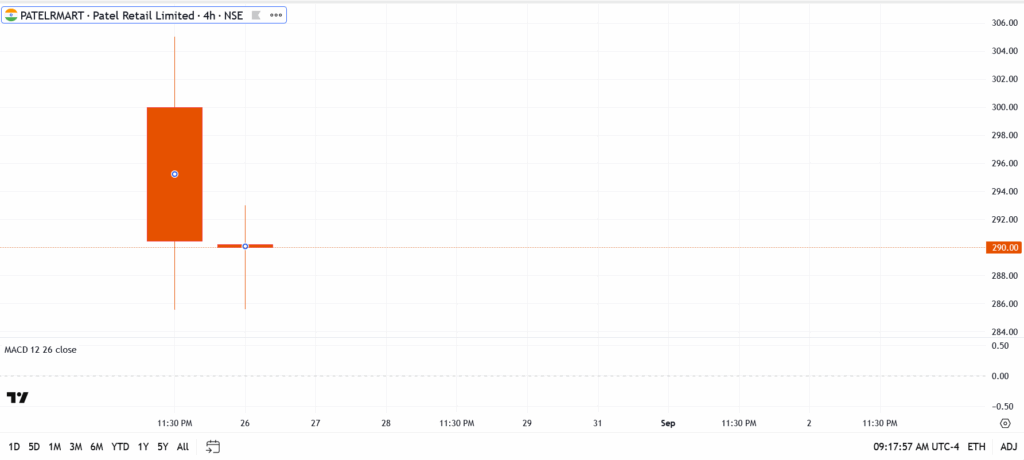

Patel Retail (NSE, BSE: PATELRMART) entered the markets with a bang on Tuesday, debuting at ₹300 per share, a 17.65% jump over the IPO issue price of ₹255. The stock touched a high of ₹305 on its first day before settling lower at ₹290 by the close. In Wednesday’s follow-through session, Patel Retail held flat at ₹290, showing that early enthusiasm has cooled as the market waits to see if fresh buyers will step in once the post-listing dust settles.

How Did Patel Retail Trade After the Bell?

The stock’s first ticks told the story, a quick sprint to ₹305, nearly 20% above issue price, before supply kicked in. By afternoon, Patel Retail had slipped to an intraday low of ₹285.55, trimming much of its opening burst. It eventually settled around ₹290, still well ahead of its IPO price but short of the euphoria some retail bidders were hoping for.

Volumes were heavy, with 36 lakh shares changing hands and turnover topping ₹106 crore. Market cap at close stood near ₹968 crore, a decent size for a Maharashtra-focused retailer making its first market appearance.

Why Was Demand So Strong?

The IPO was already one of the year’s more talked-about offerings, with bids flooding in across categories. Final subscription came in at a stunning 95.7 times overall:

- QIBs: 272x – the big money clearly liked the story

- NIIs: 50.9x – high-net-worth players piled in

- Retail: 7.65x – smaller investors also joined the rush

Such a split shows this wasn’t just hype; institutions were leading the charge. Their interest gives Patel Retail credibility, but also raises expectations; now the company has to deliver.

What’s Next for Patel Retail?

Patel Retail runs supermarkets and FMCG distribution hubs, with its base in Maharashtra. Its bread-and-butter business is essential goods, food staples, household items, and daily needs. Those are steady categories, less exposed to economic swings, but growth won’t come easy.

The bigger challenge: scaling up beyond its home turf. National chains are pushing harder into Tier-2 and Tier-3 cities, while regional rivals guard their turf aggressively. For Patel, execution will matter more than market hype.

Patel Retail Chart Analysis

- Support: ₹285, then ₹270 if sentiment sours

- Resistance: ₹300, with a breakout target of ₹305

For now, the ₹285–₹300 band is the battlefield. A hold above ₹285 keeps bulls in control; a slip could shift the momentum fast.

Conclusion

Patel Retail’s IPO debut ticked the right boxes, a premium listing, heavy volumes, and record subscriptions. But strong openings are only the starting line. The company now has to prove that it can turn early excitement into lasting growth. With margins under pressure and bigger rivals circling, the next chapters will be written not by listing-day hype but by how Patel’s R Mart stores perform on the ground. For investors, the real story begins once the IPO glow fades, will Patel build on its ₹290 foothold, or will the market test its conviction in the weeks ahead?

Yes. The stock listed at a premium of nearly 18% and attracted overwhelming demand, with QIBs bidding over 272 times. That kind of subscription shows strong institutional conviction.

Patel Retail was established in 2008, opening its first store in Ambernath, Maharashtra. Since then, it has steadily expanded across Thane and Raigad districts, serving tier-III cities and suburban pockets. Under the ‘Patel’s R Mart’ brand, the company sells everything from food and household goods to general merchandise and apparel, catering to everyday family needs.

Expansion beyond its home base is the key. Analysts highlight scaling into new regions, tightening margins, and leveraging India’s growing FMCG demand as the company’s biggest catalysts.