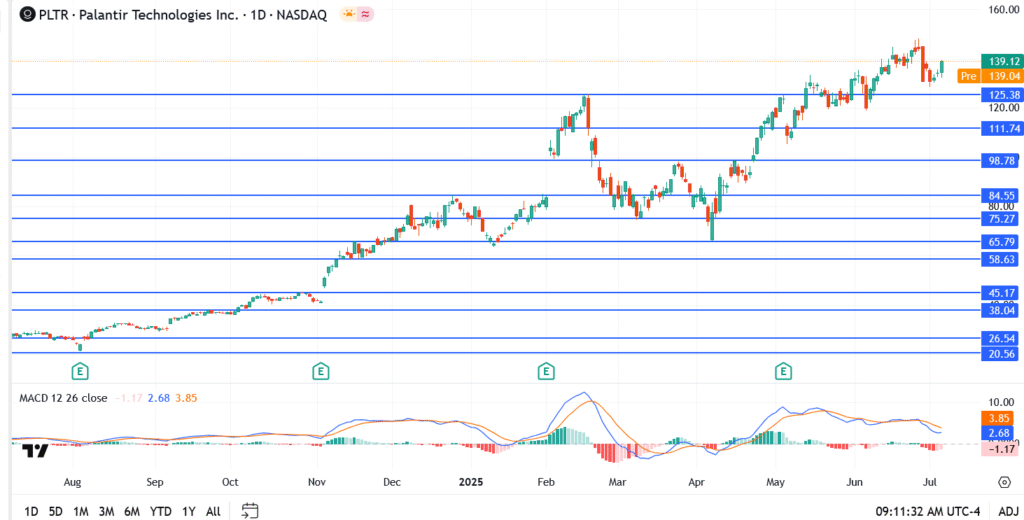

Palantir shares are holding near $139 in Tuesday’s premarket session, just shy of recent all-time highs. The stock has more than doubled in 2025, riding the wave of AI optimism, government contracts, and bullish retail sentiment. But with momentum showing signs of fatigue, the question on many minds now is: Is Palantir overvalued?

The short answer is, it depends on what you believe about its future.

Growth vs. Valuation: The Core Debate

Palantir is no longer a quiet defense tech play. It has repositioned itself as an AI-first platform with government and commercial data integration at the core. That’s fueled a rally from under $60 in January to nearly $140 today.

But the company still trades at a rich multiple, with forward P/E and price-to-sales ratios far above sector averages. For investors who value cash flows and fundamentals, Palantir’s valuation now bakes in years of perfect execution. And that’s a tall order.

The bullish camp sees this as the early innings of a long-term transformation, comparing Palantir’s growth trajectory to early-stage Microsoft or Salesforce. The bearish view? Great company, maybe, but at a price that leaves no room for error.

Palantir Technical Breakdown

- Current Price: $139.04

- Resistance Levels: $139.12, then $145

- Support Zones: $125.38, followed by $111.74

- MACD: Losing steam, negative crossover forming

Verdict: Should Palantir Investors You Worry?

If you’re in it for the short-term ride, this might be a good time to lock in profits or tighten stops. The stock looks technically stretched and vulnerable to a pullback if momentum continues to fade.

But if you’re a long-term believer in Palantir’s AI moat, disruptive potential, and government pipeline, then valuation might matter less than execution.

At $139, Palantir isn’t cheap, but for some, it’s not supposed to be