Nvidia stock (NASDAQ: NVDA) trades near $180 in Tuesday’s pre-market, steady ahead of its Q2 earnings report due Wednesday after the close. Wall Street expects revenue of $46.45 billion, up 54.6% year on year, with adjusted earnings per share projected at $1.01. The numbers matter not just for Nvidia, but for the entire equity market, with the chipmaker now viewed as the bellwether for AI chip demand.

What Are Analysts Expecting From Nvidia’s Q2?

Analysts are entering this report with cautious optimism. Nvidia has beaten revenue estimates in each of the past eight quarters, topping forecasts by an average of 7%. The strong demand for AI server chips drove a 69% year-over-year increase in sales to $44.06 billion in the most recent quarter. Even while growth is predicted to slow, most analysts still predict a significant double-digit rise that would solidify Nvidia’s leadership in the AI semiconductor market.

Will China and the H20 Chip Shape the Nvidia Outlook?

One key risk is Nvidia’s exposure to China amid ongoing U.S. export restrictions. Investors will be paying close attention to commentary on the H20 chip, which was specifically designed to meet regulatory requirements while serving the Chinese market. How quickly Nvidia can scale H20 shipments could determine whether it can maintain momentum in Asia or whether geopolitical friction becomes a drag on results

How Are Peers Performing Ahead of Nvidia’s Report?

Qorvo and Lattice Semiconductor, both in the same processor and chip segment, recently reported mixed Q2 results. Qorvo’s revenue fell 7.7% year on year but still beat estimates, while Lattice posted flat growth in line with expectations. The muted tone across peers has put even more weight on Nvidia’s ability to deliver strong numbers and guidance that reassures investors the AI boom is not slowing.

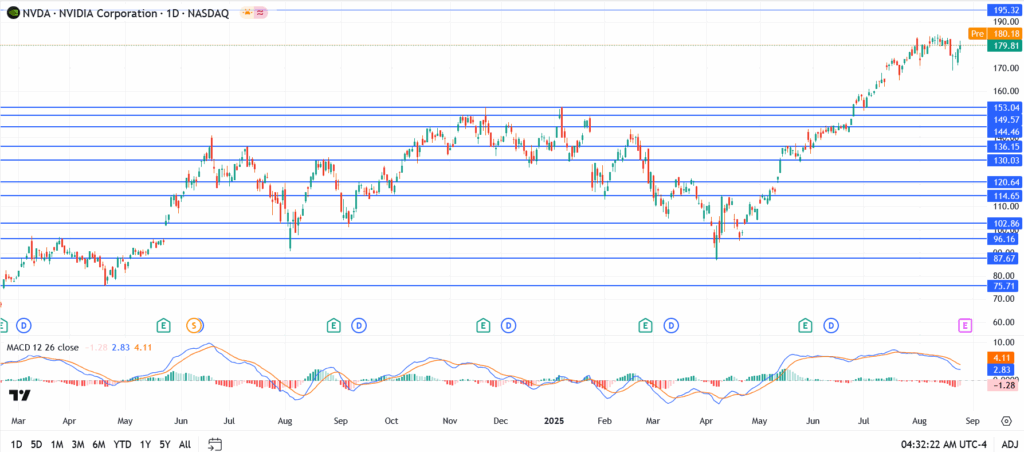

Nvidia Chart Analysis Today

- Current price: $180.30

- Resistance: $185.00,$195.32

- Support: $175.00, $165.00

Could Nvidia Earnings Shift the Broader Market Mood?

Investors aren’t just looking at Nvidia as one stock anymore, they see it as the heartbeat of the AI trade that has lifted indices all year. When Nvidia reports, the reaction often extends far beyond semiconductors, spilling over into cloud providers, software firms, and even industrial names tied to automation. That’s why tomorrow’s numbers could act like a pressure test for the entire rally.

If the company delivers another clean beat and raises guidance, it could re-energize risk appetite across the Dow Jones, S&P 500, and Nasdaq, with tech leading the charge higher. On the other hand, even a slight miss or cautious commentary on AI demand could cool enthusiasm quickly, particularly with markets stretched after Powell’s dovish signal last week. In that sense, Nvidia’s results aren’t just about chips, they are a referendum on whether the AI boom still has fuel, or if the market has gotten ahead of itself.