NIO Inc. (NYSE: NIO) extended its rally this week after posting Q2 results that reassured investors, lifting the stock to $6.49 in today’s session. The Chinese EV maker delivered stronger revenues and slimmer losses, giving the market a sense that the turnaround story is gaining traction.

Nio Q2 Earnings at a Glance

Revenue came in at $2.65 billion, up 9% year-on-year, though slightly below consensus estimates. Adjusted earnings per share landed just ahead of forecasts, helped by rising deliveries and improved vehicle margins, which climbed into double digits for the first time this year. Deliveries hit 72,056 units, up more than 25% year-on-year, with management guiding for 89,000 in Q3, a 44% jump if achieved.

Margins remain the key debate. While second-quarter gross margin was about 10%, analysts see modest improvement in Q3 as material costs ease and the new L90 SUV gains traction. Still, long-term targets north of 20% are seen as tough to achieve given China’s relentless EV price war.

What Analysts Are Saying

Market watchers are divided on the stock’s path from here. Some see upside in the near term, pointing to rising volumes, improving cost control, and a product lineup that could extend growth into 2026. Upcoming launches like the ES9 and ES7 are flagged as potential catalysts. Others remain cautious, noting that while sales momentum is improving, profitability goals may remain out of reach as competition intensifies. Price targets have been adjusted upward following Q2, but most calls still cluster around the $6–$8 range, suggesting limited room before valuation risks catch up.

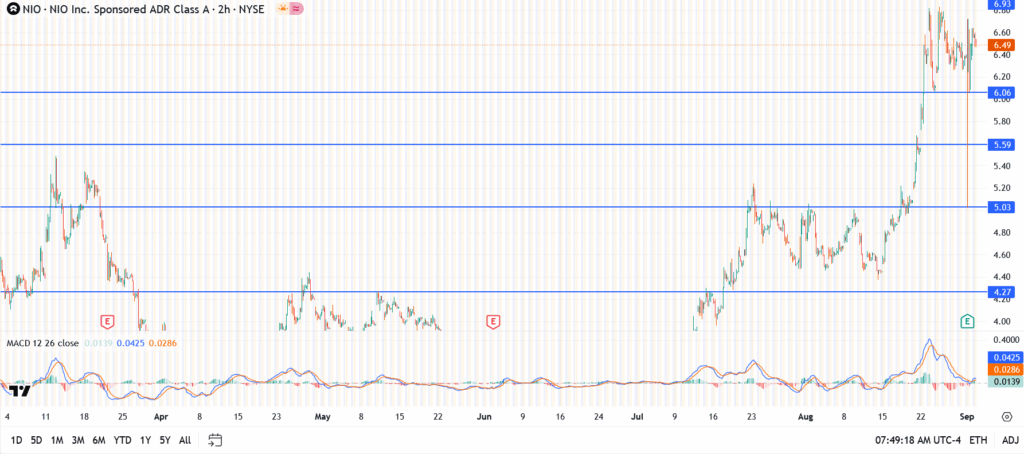

NIO Chart Analysis Today

- Current price: $6.49

- Resistance: $6.93 is the key ceiling; a breakout could unlock $7.50.

- Support: $6.06 remains the immediate floor, with $5.59 and $5.03 below.

Can NIO Really Hit 89,000 Deliveries in Q3?

NIO is aiming for 89,000 vehicles this quarter, a bold target that would mark more than 40% growth. The reality is monthly output is still closer to 37,000. To get there, production has to ramp up quickly, and that’s what traders are watching. If the pace doesn’t accelerate, the stock could lose steam.

Outlook

NIO’s earnings beat has sparked fresh optimism, but the real test will be whether deliveries and margins can sustain the pace into year-end. For now, the $6 zone is the key battleground. A decisive hold could keep momentum alive, but any slip in execution may see traders test support again.

The company keeps betting on its battery swap stations to stand out in China’s crowded EV market. It’s a clever way to reduce charging wait times, and it could build recurring revenue. But rolling out more stations costs money, and the question is whether demand will justify that heavy spend.

Margins ticked higher last quarter, with vehicles at just above 10%. Management says they can push that a little higher in Q3 as costs ease. Still, compared with global leaders that run closer to 18% or more, the gap is clear. Price cuts across the Chinese EV market make the road to 20% margins a tough one.

At around 0.8 times projected sales for 2026, NIO’s valuation sits in the same zone as XPeng and Li Auto. After climbing more than 50% this year, the stock doesn’t look like a deep bargain. Bulls say delivery growth could still drive another leg higher, but skeptics argue competition and thin margins cap the upside.