- The $82.7 billion acquisition is already facing pushback from politicians and trade unions.

- Regulatory authorization procedures could last well past 2026.

- Netflix could borrow $59 billion to finance the acquisition.

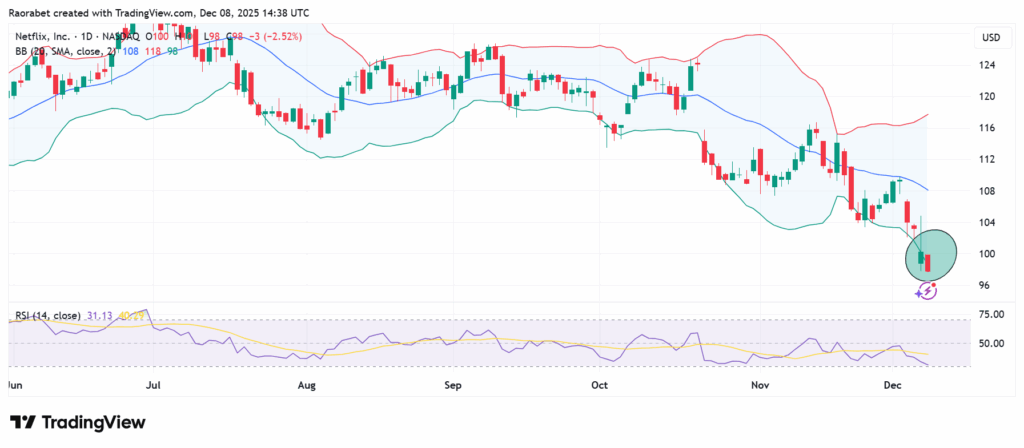

In the world of digital entertainment, things change all the time. But, few announcements carry the seismic weight of Netflix’s December 5, 2025, revelation, a $82.7 billion acquisition of Warner Bros. Discovery’s studios and streaming assets, including HBO Max. Yet, the market’s response was anything but unified. Netflix (NASDAQ: NFLX) shares plunged 2.9% to $100.24 on Friday

What’s in the deal?

According to Netflix’s official statement, the deal involves $23.25 in cash and $4.50 in Netflix stock for each Warner share. It’s the biggest merger ever in streaming. The main targets are Warner’s valuable assets, like its large movie collection, DC Comics properties, and HBO’s hit shows.

News agencies like Reuters reported the total value to be $82.7 billion. The merger is planned to be complete by the third quarter of 2026, waiting for approval from regulators. This isn’t just combining companies; it’s a calculated move by Netflix to strengthen its position.

By gaining access to many hours of HBO shows and Warner’s movies, Netflix hopes to add 50 million new subscribers, according to TIME magazine. According to financial earnings reports, Warner has lost more than $10 billion on streaming since 2022. This is a way for them to get out of that.

Implications of the Deal

The proposed acquisition, valued at $27.75 per WBD share, is poised to dramatically reshape the entertainment landscape, creating a colossal new entity. If approved and an enviable library of intellectual property (IP).

The most obvious result is the creation of a major streaming player. Netflix, already the top service, will gain control of content like the DC Universe, the Harry Potter series, and HBO’s popular shows such as Game of Thrones and The Sopranos.

For consumers, Netflix co-CEO Ted Sarandos has suggested the deal is “pro-consumer,” promising an “extraordinary offering” and potentially lower prices through service bundling, such as integrating HBO Max into the Netflix platform. Still, some critics, including politicians like U.S. Senator Elizabeth Warren, are worried it could create a monopoly, possibly leading to higher prices and fewer options for consumers because of reduced competition.

Also, the acquisition has met with strong resistance from all around the entertainment sector. Hollywood unions like the Writers Guild of America (WGA) and the Directors Guild of America (DGA) have vocally criticized the merger. The WGA argues that allowing the biggest streaming company to buy one of its main rivals goes against antitrust laws, and they fear job losses, lower pay, and reduced creative diversity.

Why Netflix Investors are Skeptical

First, Netflix agreed to a staggering $82.7 billion enterprise value, including $10 billion in WBD debt. To finance this, Netflix secured a $59 billion bridge loan from Wall Street banks (as reported by Bloomberg). This substantial increase in debt load introduces significant financial risk. Many Netflix investors, who valued the company for its lean, organic growth model, are now concerned that the company is overpaying for the assets and shifting to a riskier growth-by-acquisition strategy.

Secondly, the deal brings a dilution risk. It is a cash-and-stock transaction. Issuing new Netflix shares to WBD stockholders could lead to equity dilution, lowering the value of existing shares.

Why Warner Bros. Discovery’s Investors Are Happy

The rise in Warner Bros. Discovery’s stock (WBD) shows that its investors see immediate financial benefits. News outlets like USA Today point out that this mix of cash and stock gives them money right away while connecting Warner’s future to Netflix’s growth, potentially creating $2 billion in shared savings through common technology.

Netflix is offering $27.75 for each Warner Bros. Discovery share, which is more than the stock was worth before the deal was public. Warner Bros. Discovery’s owners are getting a guaranteed, quick, and valuable way to exit from their holdings. In simple terms, Warner Bros. Discovery’s shareholders will get cash ($23.25) and Netflix stock ($4.50) for each share, giving them immediate money and a stake in the larger entertainment company.

Netflix Stock price on December 8, 2025. Source: TradingView

The main concern is the debt burden. Netflix is taking on a massive amount of debt, including a $59 billion bridge loan, to finance the acquisition, which increases its financial risk profile and prompts investor skepticism.

The principal argument is antitrust. Critics argue the merger creates an overly dominant media giant controlling nearly half of the global streaming market, potentially leading to fewer consumer choices and higher prices.

The deal offers Warner shareholders $27.75 for each share they own ($23.25 in cash plus $4.50 in Netflix stock). That’s about a 25% increase compared to where the stock was on Thursday. So, for those who’ve been holding on, it’s a pretty good return.