U.S. futures are flashing red ahead of the bell, led by Tesla, which fell nearly 14% last Thursday, wiping out over $150 billion in market value following a heated public conflict between Elon Musk and President Trump.

As Tesla tests key support levels this morning, other Nasdaq-listed names, Robinhood, Plug Power, and Children’s Place, are making notable moves in pre-market trade. Here’s the full rundown, combining technical levels and market catalysts.

Tesla (TSLA): Down 3% Pre-Market as Trump Attacks Wipe $150B from Market Cap

Tesla shares are once again under pressure, falling nearly 3% before the bell and trading around $287. This follows Thursday’s historic $150 billion selloff that saw the stock post its worst single-day loss in over a year. The slide came after Donald Trump, now firmly campaigning for a return to the White House, took direct aim at Elon Musk, accusing him of “grifting taxpayers” through EV subsidies.

The rhetoric spooked Wall Street. With Trump leading in several key polls, markets are suddenly reevaluating just how safe Tesla’s government-backed business model really is. Price has now sliced through multiple key support levels, and with the next major floor sitting at $271, bulls have their backs against the wall. Momentum indicators show clear exhaustion, and unless Musk stages a damage control rally, this trend could get worse before it gets better.

Robinhood (HOOD): Sinks 5% After Being Snubbed from S&P 500 Inclusion

Robinhood is trading sharply lower in the early session, down about 5% to hover near $71. The drop comes after the popular trading app was left out of the latest S&P 500 rebalancing, disappointing speculators who had positioned for a surprise inclusion.

The miss not only delays potential passive inflows from index funds, it also renews doubts about the company’s earnings quality and profitability trajectory. Technical traders are eyeing $66.85 as a make-or-break level. If that fails to hold, a further correction toward $60 can’t be ruled out. Volume is already elevated in pre-market orders, suggesting the reaction may accelerate once the bell rings.

Plug Power (PLUG): Flat at $0.97 as Investors Wait for Clarity

Shares of Plug Power remain muted ahead of the open, trading flat at $0.97. The stock has been stuck in a tight consolidation range for weeks, unable to sustain upside despite sector-wide interest in clean energy and hydrogen storage.

Investors appear to be waiting for a new round of updates, possibly around new fuel cell contracts or production milestones. For now, the technical outlook is neutral. The RSI is coiling near 50 and MACD is flat, pointing to indecision. If bulls want to reclaim momentum, they’ll need to punch through the $1.03 resistance with strong volume. Otherwise, a retest of the $0.92 demand zone may be next.

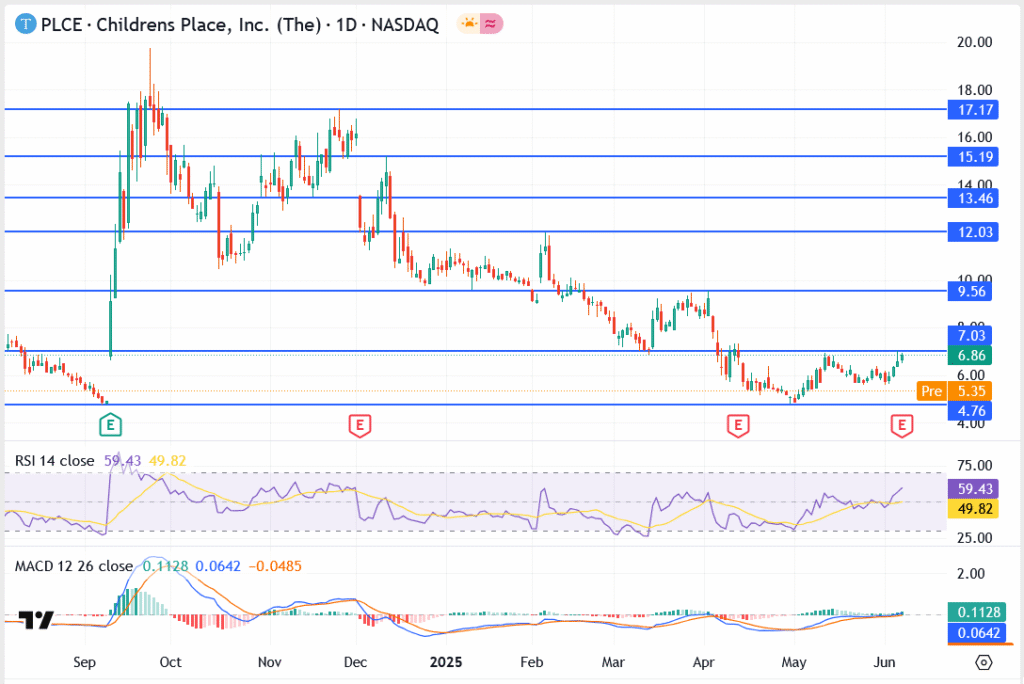

Children’s Place (PLCE): Bounces 6% After Friday’s 22% Meltdown

Retail stock Children’s Place is seeing a sharp rebound this morning, up more than 6% in early trade near $6.86. This comes after the stock collapsed 22% on Friday, triggering stop losses and wave after wave of panic selling following a brutal Q1 earnings miss.

The bounce appears driven by short-covering and speculative dip buying. While the fundamentals remain shaky, some traders are looking to play a technical rebound toward $9.50, the last significant pivot before the collapse. The setup is fragile though. If buying dries up mid-session, the rally could fizzle just as quickly as it appeared.