Lloyds Bank (LSE: LLOY) is trading softer today, but investors aren’t walking away. Despite the dip, the bank’s long-running buyback and rising dividend outlook continue to offer a solid base for value-focused buyers.

The stock remains priced under 80p, technically still a penny stock even as it churns out stable earnings and returns capital at a steady clip. That disconnect has become part of the Lloyd’s narrative. For many, it’s not about chasing short-term highs; it’s about quietly compounding.

Lloyds Share Buyback 2025: £1.7 Billion Program Supports Share Price Stability

Lloyds began its latest buyback cycle in February, with £1.7 billion earmarked to retire shares through year-end. That’s more than just capital discipline; it’s a signal. Fewer outstanding shares mean higher earnings per share and a stronger dividend runway. This year’s payout is already on track to grow from 3.17p toward 4p by 2027, based on internal forecasts. With UK bond yields stabilising, that makes Lloyds an appealing yield play for those parking cash long-term.

Why Lloyds Still Trades as a Penny Stock Despite Strong Fundamentals

For all its progress, Lloyds still trades like a beaten-down financial. Sub-80p pricing keeps it stuck in the psychological “cheap” zone, even though the bank’s fundamentals suggest otherwise. The motor finance litigation remains a cloud, but Lloyds has already provisioned £1.2 billion for potential settlements.

Unless those legal costs spiral, the stock may be undervalued relative to peers. That view is gaining traction as income investors increasingly treat Lloyds like a reliable dividend machine.

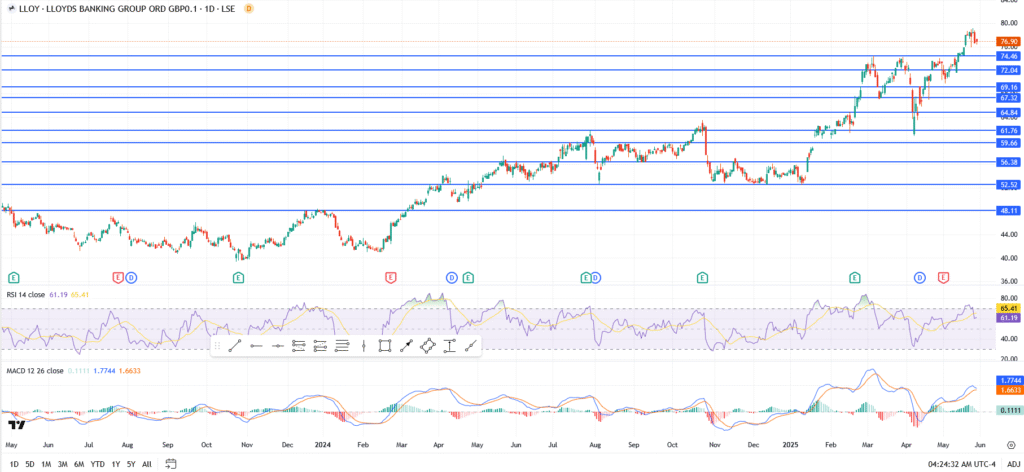

Lloyds Share Price Technical Analysis: Support Holds Above 76.50p

- Price currently holding just above 76.50p, short-term support zone

- If momentum returns, buyers will look to reclaim 78.14p

- Further upside capped near 78.98p, with 80p still acting as a ceiling

- A deeper retracement brings 75.60p back into focus

The price is cooling off, but structurally, not much has changed. The buyback is active. Dividends are growing. And for investors with patience, Lloyds still offers more than its penny status suggests.