- IAG seals $560M RACQ deal, boosting underwriting power and long-term premium flows. A strategic alliance set to reshape its growth trajectory.

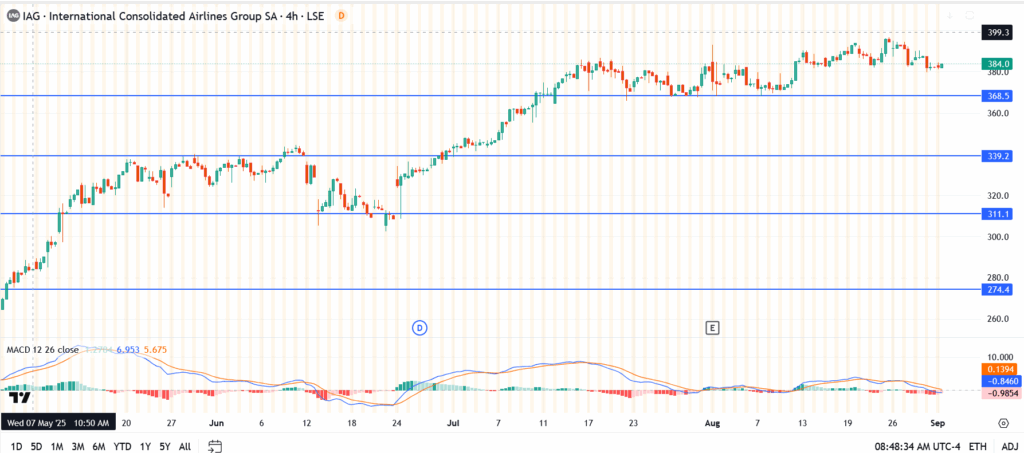

International Consolidated Airlines Group (LSE: IAG) traded near 384p in Monday’s session, consolidating just below the 399p ceiling after weeks of steady gains. The chart shows buyers have defended the 368p support, with momentum building from May’s 274p lows. Despite some cooling in August, the uptrend remains intact, and today’s news may provide a fresh catalyst.

Why the RACQ Deal Matters for IAG

IAG confirmed it has finalized the $560 million acquisition of RACQ’s underwriting unit, striking a long-term alliance with the Queensland-based group. The move extends IAG’s reach into a growth market, while also securing an important distribution partner in Australia’s competitive insurance sector. Management described the deal as a “transformational step” in building scale and reinforcing IAG’s balance sheet strength.

Nick Hawkins

Today is an exciting day as we begin our partnership with RACQ, supporting its member-first approach, welcoming around 840 new team members to IAG, and strengthening our commitment to Queensland.

IAG Managing Director and CEO

For investors, the deal underlines IAG’s intent to play offense rather than defense. The tie-up brings RACQ’s wide customer base into IAG’s orbit, giving the group a distribution edge that competitors can’t easily replicate. Stronger access to recurring premiums should lift margins over time, while the structure of the alliance locks in market share for the long haul. In insurance, scale and reach are everything, and this move delivers both.

IAG Chart Analysis

- Current price: 384p

- Immediate support: 368.5p

- Deeper support zones: 339p, then 311p

- Overhead resistance: 399p, with breakout potential to 420p

The MACD shows flattening momentum, but the bullish structure is intact as long as 368p holds. A close above 399p would signal fresh upside, potentially targeting the 420p–430p band in coming weeks.

Is IAG Positioned for More Upside?

The RACQ alliance comes at a time when global insurers are under pressure from higher claims costs and regulatory shifts. For IAG, diversifying exposure and locking in a stable partnership could be the difference between lagging peers and setting the pace. However, execution will be key. Integrating RACQ’s unit smoothly, while delivering promised cost synergies, will determine whether the deal translates into shareholder value.

For now, the market reaction has been measured, but the fundamentals point to a stronger long-term story. If the stock clears 399p convincingly, investors may view today’s alliance not just as a regional play, but as the start of IAG’s next leg higher.

A recurring theme: IAG’s focus on transatlantic travel has helped reinstate its dividend and accelerate debt paydowns. With premium cabins back in favor and consumer demand soaring, many are searching whether this remains a winning play given shifting global travel patterns.

Operational hiccups at BA, especially delays and customer complaints, have been headline fodder. As IAG commits billions to upgrade service, airline enthusiasts and holders alike are asking: can these plans translate into better reliability and stronger market sentiment?