- The upbeat sentiment on HDB Financial is likely to remain in play as both institutional and retail investors buy its strong fundamentals

HDB Financial Services (NSE: HDBFS) share price has extended its upside trajectory, with investors buying into the high price target projections. A day after its debut at the NSE, the Non-Banking Financial Services provider traded at ₹873 at the time of writing, having gained 3.9% on the daily chart. The post-listing momentum will likely stay in play as the company’s fundamentals underlined by strong rural reach and low levels of Non Performing Assets (NPA) provide propulsion.

Short-term investors will likely be targeting the ₹800-₹900 mark as trigger points for a selloff, which carries an underlying risk. On the other hand, value investors are likely see it as an early-stage opportunity to invest in a company backed by strong growth background. With more than 18% gains in just two sessions, the optimism around the stock will likely linger on for the better part of July.

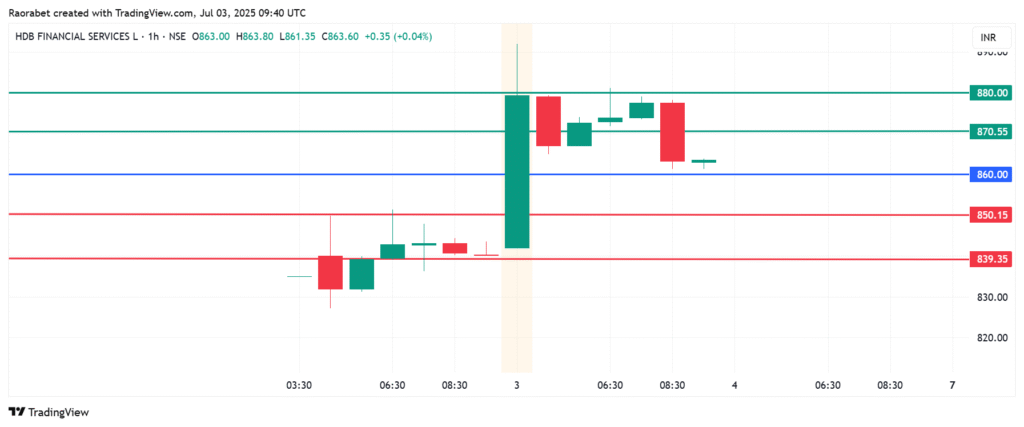

The high trading volume and consistent buying interest signals growing interest in HDB share price beyond the IPO hype. Furthermore, the broader equities market is currently experiencing significant volatility, affirming strong conviction among institutional and retail investors. The company’s fundamentals are doing the heavy lifting, with its strong loan book, and hold of rural populations projecting its business model as stable and scalable. On the technical front, a break above the ₹870 barrier strengthens the upside traction.

HDB Share Price Prediction

HDB Financial share price pivot mark is at ₹865 and the current momentum calls for further upside. With the buyers in control, the coin will likely rise further and meet initial resistance at ₹880. Breaking above that level will signal a stronger momentum that could push the price to test ₹885.

On the other hand, breaking below ₹860 will signal the onset of a downward trajectory. Initial support will likely be at ₹860.15. The upside narrative will be invalid if the price breaks below that level. Also, an extended control by the sellers could push the price lower to test ₹839.35.

This article is also available in: Polski, Nederlands, हिन्दी, Deutsch, Italiano, Español, Türkçe.