- HDB Financial shares debut at ₹840, a 13% premium over IPO price. Market cap hits ₹69,625 crore as stock lists on NSE. Emkay sets ₹900 target.

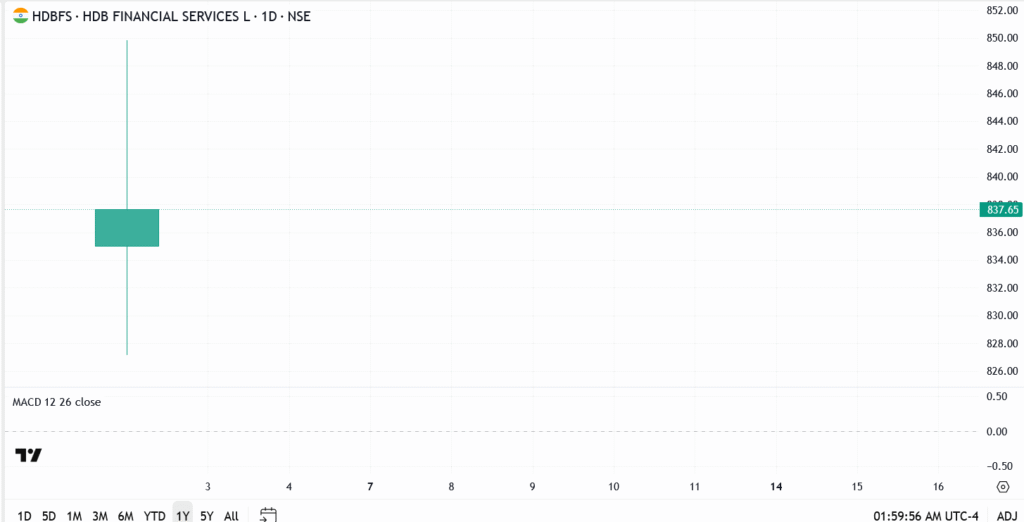

HDB Financial Services made a strong entry on the bourses on July 2, listing at ₹840 per share, a 13% jump over its IPO price of ₹740. The debut gives the company a market capitalization of ₹69,625.50 crore, placing it among India’s top ten most valuable non-banking financial companies (NBFCs).

The listing surprised to the upside, beating most market expectations and instantly positioning itself as the biggest IPO of 2025 so far. At its debut valuation, HDB trades at a one-year forward price-to-book multiple of 3.4x. That’s cheaper than Bajaj Finance and Chola Investment, but priced above Shriram Finance, which trades at around 2x. In short, HDB starts out in the mid-range, with potential for upside if growth holds steady.

Brokerage Coverage and Forward Outlook

With a “Buy” rating and a target price of ₹900,Emkay began coverage, indicating a 22% increase from the issue price. analysts anticipate that AUM will expand at a compound annual growth rate of 20% Over the next three years.

Still, there are regulatory risks to consider. The Reserve Bank of India’s draft circular from October 2024, which suggests banks and their subsidiaries must avoid overlapping business lines, could potentially reshape how HDB operates if the proposal becomes policy. For investors, that’s a key area to monitor.

What to Watch Ahead

- Listing price: ₹840

- IPO price: ₹740

- Market cap: ₹69,625.50 crore

- Forward P/B: 3.4x

- Broker target (Emkay): ₹900

- Upside potential: +22%

- Regulatory risk: RBI’s business overlap proposal

Investor appetite for quality NBFCs clearly remains strong, especially when backed by large banking groups. While HDB Financial Services begins its public market life with solid momentum, how it handles regulatory shifts and maintains AUM growth will likely determine its re-rating potential over the long run.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.