- OCTO stock price shot up by more than 3,000% on Monday and there are concerns (rightfully so) as to whether it can protect the gains.

Eightco Holdings’ stock price registered a dramatic spike, gaining more than 3,000% in one day on Monday, and grabbing news headlines. A pair of key announcements set off this unexpected and enormous rise. First was the appointment of Dan Ives, a prominent Wall Street analyst from Wedbush Securities, as the company’s new Chairman of the Board. Second, a major stake shakeup injected fresh impetus around the company’s finances.

What is Eightco Holdings and What Does It Do?

Eightco Holdings (NASDAQ: OCTO) is a technology holding company that focuses on acquiring and managing tech companies, especially those that work in e-commerce. The company has two main subsidiaries: Forever 8, which gives e-commerce sellers a platform for keeping track of their inventory, and Ferguson Containers, Inc., which makes and ships products. Through smart acquisitions and management, the company’s goal is to find and grow technological firms that have untapped potential.

Why Did OCTO Stock Spike?

Despite its potential, the company has always been shrouded in mystery and boasted a modest market cap. Eightco’s stock stayed below $2 per share for much of 2025 because its sales were connected to unpredictable retail cycles and it had a history of slow growth—evidenced by a negative return on equity of -87.96%.

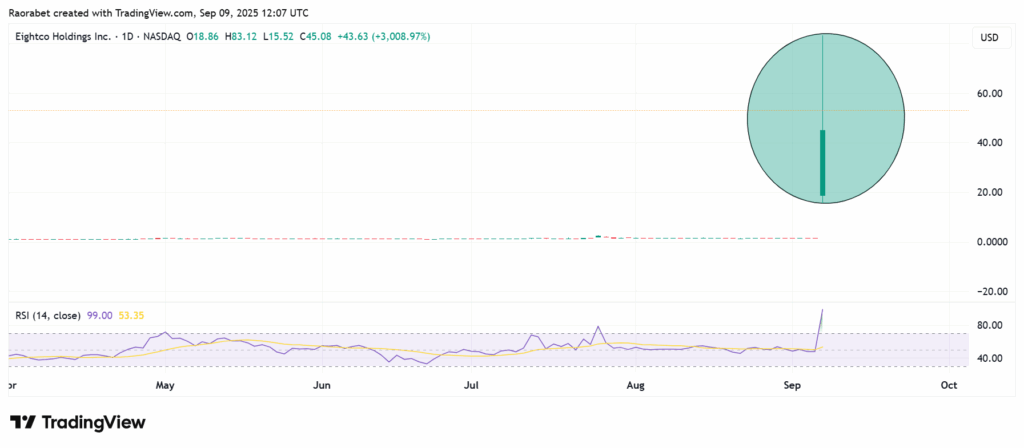

On September 8, 2025, all changed as Eightco’s shares shot up. OCTO stock price shot up from a Friday closing of $1.45 to intraday highs of $83.23 before stabilizing around $45–$67. Also, the news that Ives would be the next chairman of the board and that a large shareholding will be readjusted has made the market perceive that a renaissance might be coming. First, the company’s reputation and Ives’s optimistic outlook on the tech sector contributed to a great deal of goodwill.

Secondly, the unveiling of a $250 million private placement and a further $20 million strategic investment from BitMine Immersion Technologies (BMNR) marks a new chapter in the company’s market positioning. This important capital raise aims to finance the acquisition of Worldcoin (WLD), a digital currency. Eightco is looking to make Worldcoin its main treasury reserve asset, with Ether (ETH) possibly serving as a secondary reserve.

Chart showing Eightco (OCTO) stock price spike on Monday, September 7th, 2025 with RSI at 99. Source: TradingView

With this action, the company becomes one of the first publicly traded firms to launch a Worldcoin treasury strategy, seizing the burgeoning interest in digital assets and the future of AI-driven human verification, which is central to Worldcoin’s mission. The private placement is anticipated to close on or about September 11, 2025.

The market’s view of Eightco Holdings has been fundamentally transformed by this strategic move from a traditional e-commerce holding company to one with a significant investment in a major cryptocurrency. The announcement has sparked a frenzy of investor interest, much like the similar surges seen in other small-cap companies that have revealed digital asset treasury strategies.

Growth Outlook and Risks

The growth outlook for Eightco Holdings is now primarily linked to its new strategic direction. By shifting to a Worldcoin treasury strategy, the company is opening itself up to major opportunities as well as significant risks.

Armed with $270 million in new capital, the company could leverage Worldcoin’s iris-scanning identity protocol and its increasing use in AI-driven economies, potentially replicating the treasury successes of companies like MicroStrategy with Bitcoin.

Ives’ participation could draw in institutional investors, and the e-commerce arm offers stability amidst the crypto gains. If WLD appreciates, analysts predict explosive revenue, making Eightco a high-beta play in the digital asset space.

Nonetheless, there are numerous risks. Despite the high valuations as of September 9, 2025, this treasury bet could be a game changer for Eightco for investors willing to take on risk. Additionally, the cryptocurrency market is well-known for its extreme volatility. Worldcoin’s value could change dramatically, putting Eightco’s balance sheet at significant risk. Because of this volatility, the stock price could experience large fluctuations, which makes it a high-risk investment.

Moreover, the move to a crypto-focused strategy might divert attention from the company’s original e-commerce operations. Although the company has announced it will keep its focus on its core business, neglecting to balance the two could put its current revenue streams at risk.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.