- Broadcom surges as reports link it to OpenAI’s first AI chip deal, fueling hopes it could challenge Nvidia’s dominance in the AI race.

Broadcom (NASDAQ: AVGO) roared higher on Friday, soaring nearly 17% to $348 in premarket trading after unveiling a blockbuster $10 billion AI chip order. The news sent shockwaves through the semiconductor sector as reports surfaced that the unnamed customer could be none other than OpenAI, the maker of ChatGPT.

The surge comes just as Nvidia (NASDAQ: NVDA), the current AI chip king, faces fresh questions about whether rivals are starting to chip away at its dominance. For investors, the takeaway is clear: the generative AI race is no longer a one-horse show.

Why Broadcom’s OpenAI Deal Matters

Broadcom isn’t just riding an earnings pop, reports say it’s helping OpenAI design and manufacture its first in-house AI chip. That’s a big break from the “buy Nvidia GPUs” playbook and a clear signal that the most demanding AI customers want bespoke silicon to cut costs, dodge supply choke points, and optimize for their own workloads.

On last night’s call, Broadcom confirmed a multi-billion-dollar custom-chip order but didn’t name the buyer. Street heavyweights quickly connected the dots: based on the size, timing, and prior industry chatter, it strongly appears that the customer is OpenAI. That tracks with earlier reporting that OpenAI has been quietly working with Broadcom on a first-party accelerator, a move that would plant Broadcom right in the center of the next leg of the AI arms race.

Importantly, Broadcom already builds custom chips for top clouds. While the company doesn’t disclose names, Alphabet’s Google is widely viewed as one of its existing custom-silicon customers (alongside other mega-caps), which gives Broadcom deep experience co-designing hardware at web-scale. If OpenAI is now in the mix, Broadcom’s custom-chip franchise isn’t just growing, it’s becoming a direct counterweight to Nvidia’s one-size-fits-most GPU dominance.

Broadcom’s Q3 Earnings Top Estimates

Broadcom’s fiscal third-quarter results easily beat Wall Street expectations:

- Revenue: $13.1 billion (vs. $12.9 billion forecast)

- EPS: $10.45 (vs. $10.12 expected)

- AI Revenue Growth: +63% year-over-year

Broadcom’s CEO Hock Tan announced he will remain at the helm for at least five more years, reinforcing investor confidence in Broadcom’s long-term strategy. The company also raised its AI revenue forecast for 2026 to over $40 billion, up from $30 billion just last quarter.

Nvidia Feels the Heat

Nvidia shares slipped early Friday as traders weighed whether Broadcom’s inroads into custom AI hardware could slow its runaway growth. While Nvidia remains the leader in GPUs, the fear is that customers like OpenAI, Google, and Meta will increasingly design around Nvidia’s chips, with Broadcom as the execution partner.

That doesn’t mean Nvidia is collapsing. Its ecosystem remains unmatched, and demand for GPUs is still red hot. But the narrative that Nvidia has no rivals is being rewritten.

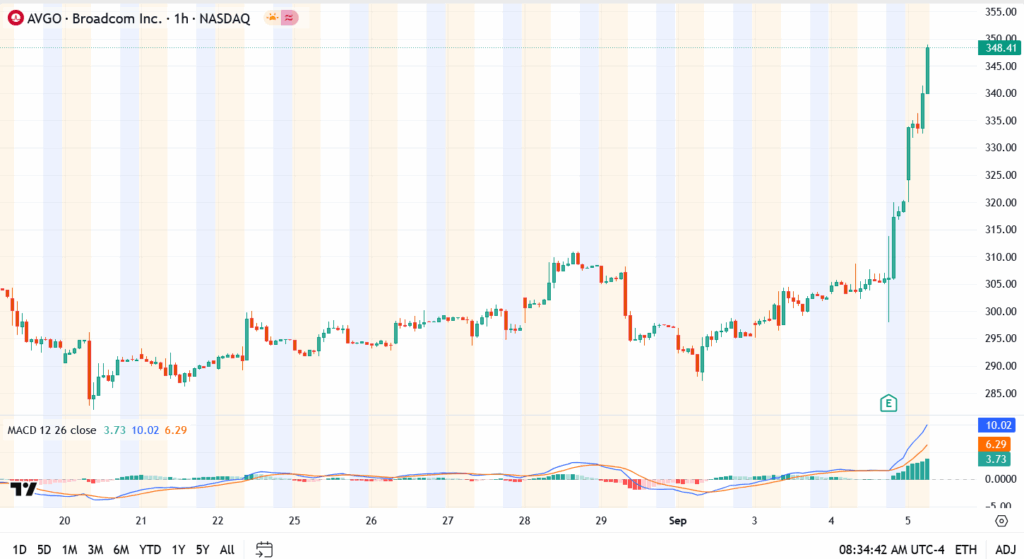

AVGO Stock Chart Analysis

- Current Price: $348 (up 17% premarket)

- Resistance Levels: $350, then $362

- Support Zones: $330, followed by $315

Broadcom Trading Opportunity

If AVGO clears $350 with volume, momentum buyers could ride it toward $362. A pullback toward $330 may offer a buy-the-dip entry, though traders should expect volatility as the market digests the OpenAI speculation.

Outlook for Broadcom Investors

Broadcom’s AI credibility has taken a huge leap forward. Securing OpenAI, or any top-tier cloud provider, as a $10 billion customer signals Wall Street that it’s no longer just a side player in AI but a direct challenger to Nvidia’s throne.

The stock is already up more than 32% in 2025 after doubling last year, and Friday’s surge could add another $160 billion to its market cap. For long-term investors, the deal validates Broadcom’s custom-chip strategy. For traders, it’s a reminder that AI’s winners won’t be limited to Nvidia alone.

Not overnight, but the challenge is real. Nvidia still rules the GPU market, yet Broadcom is carving out a lane with custom AI chips for hyperscalers like Google, and likely OpenAI. These aren’t off-the-shelf GPUs; they’re tailored processors designed to solve supply bottlenecks and lower costs. If this strategy sticks, Broadcom won’t replace Nvidia, but it could secure a permanent seat at the AI table.

Wall Street is bullish. Several firms have raised price targets, some even eyeing $400 a share, after Broadcom confirmed its multi-billion-dollar AI chip order. Analysts argue this deal doesn’t just boost near-term earnings, it expands the company’s runway in AI infrastructure well into 2026. The takeaway? Investors are beginning to view Broadcom not just as a semiconductor giant, but as a critical enabler of the generative AI boom.