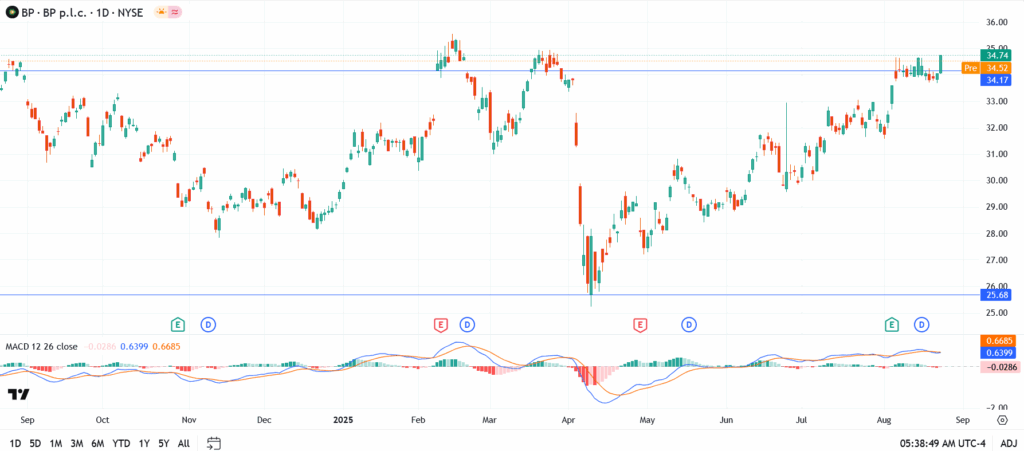

BP shares are a little changed in Monday’s pre-market session, trading near $34.74 in New York and 425 pence in London. The stock has been circling this band for most of August, with traders reluctant to push through the $35 ceiling that has acted like glue in recent months.

Did Powell’s Rate-Cut Hints Move Energy Stocks?

Markets are still digesting Fed Chair Jerome Powell’s comments from Jackson Hole last Friday. His signal that a rate cut could arrive as early as September has kept money flowing into cyclical and defensive names alike. For BP, the softer Fed stance matters: lower rates often bring stronger commodity flows and renewed appetite for big energy stocks. That ripple is part of why BP hasn’t broken down despite recent volatility in crude.

How Are Operations Supporting the Share Price?

On the ground, BP has avoided fresh shocks after a rocky summer. Its Whiting refinery in Indiana, disrupted earlier this month by flooding, is coming back online. That helps stabilize refining margins heading into September. Meanwhile, investors are still weighing BP’s exploration upside after its major Brazilian discovery, the company’s most significant in decades. These steady operational updates give the stock a buffer even when macro news dominates.

What Levels Should Traders Watch Now?

- Pre-market price: $34.74

- Resistance zones: $35 first, then $36.50 if momentum builds

- Support areas: $34.00 immediate, with a deeper base at $32.80

What’s Next For BP Share Price?

The short-term story is whether BP can finally crack $35 with conviction. A breakout could trigger institutional inflows and open room toward $36.50. Failure to do so keeps the stock stuck in its summer range, frustrating bulls but not alarming long-term holders. With a dividend yield above 5% and stable cash flows, BP remains a core energy pick, but the climb higher looks more like a grind than a sprint.