- BP share price slipped 1.5% despite a breakthrough in SAF approval. Can the energy giant’s SAF edge reignite momentum in 2025?

BP (LSE: BP) started the week on the back foot, with shares drifting lower in early Monday trade despite a landmark announcement in sustainable aviation fuel (SAF). The stock, trading around £5.35, slipped nearly 1.5% in premarket London action. The dip reflects broader energy-sector caution even as BP secured a major regulatory milestone that could reshape the future of aviation fuel.

Why BP’s SAF Breakthrough Matters

BP led a global taskforce to gain UK Ministry of Defence approval for co-processing SAF with up to 30% renewable feedstock, a sharp jump from the previous 5% cap. This change means refineries can now blend far higher concentrations of vegetable oils, waste fats, and other renewable sources directly into Jet A1 fuel, without needing separate infrastructure.

For investors, the win is significant. Co-processing is cheaper, scalable, and leverages BP’s existing refining footprint. Industry insiders say this approval could unlock faster SAF adoption worldwide and place BP at the center of aviation’s decarbonization drive. With governments and airlines under pressure to hit net-zero goals, BP has gained a first-mover edge in a sector set for exponential growth.

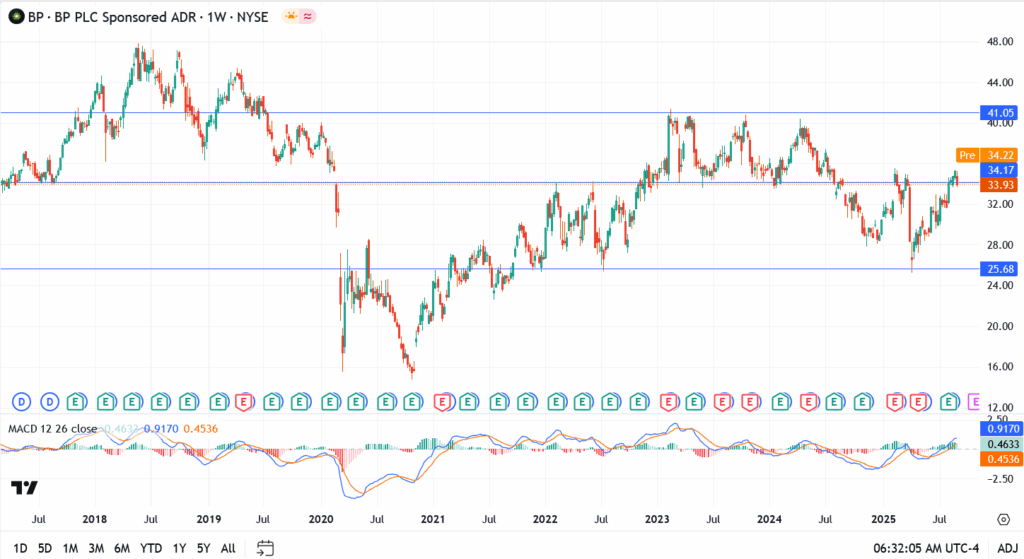

BP’s Latest Trading Performance

Despite the breakthrough, shares cooled as traders weighed profit-taking and global oil price volatility. The stock is still up roughly 8% in 2025, but momentum has been patchy as macroeconomic jitters and geopolitical risks keep energy names choppy.

BP Share Price Chart Levels

- Current Price: £5.35

- Resistance: £5.50, then £5.72

- Support: £5.20, followed by £5.05

Traders Note: A close above £5.50 could revive bullish momentum, while failure to hold £5.20 risks deeper pullbacks into the £5.05 zone.

How the SAF Deal Fits BP’s Bigger Strategy

BP’s push into sustainable aviation fuel isn’t a one-off headline. It’s part of a bigger play where the company is using cash from oil and gas to bankroll its clean energy ambitions. Because of its size and reach, BP can ride out the bumps in crude prices while still putting billions into decarbonization projects.

The SAF approval also gives BP something investors care deeply about right now, credibility on ESG. With aviation responsible for roughly 2% of global carbon emissions, proving it can lead in this space gives BP a story to tell that rivals like Shell and TotalEnergies can’t match just yet. Both competitors are chasing the SAF market, but BP’s regulatory head start puts it in front of the pack.

Outlook for BP Investors

For long-term investors, the SAF approval reinforces BP’s case as a stock that offers both dividends and exposure to the energy transition. Its strong order book, global refining footprint, and credibility in critical infrastructure remain key anchors.

For short-term traders, however, the slip below £5.35 is a reality check. Grey-market buzz and regulatory wins don’t always translate into immediate upside. The key question now is whether BP can defend the £5.20 support zone while oil prices remain volatile. If it does, September could see another attempt at reclaiming the £5.50–£5.72 band. If not, the stock may drift into a deeper consolidation phase.

FAQs on BP Share Price and SAF

Because markets trade on more than headlines. Oil price swings and profit-taking kept pressure on BP shares, even as the SAF approval marked a long-term win.

For long-term investors, yes, the regulatory edge strengthens BP’s clean energy story. But short-term traders should watch £5.20 closely, as a break lower could trigger more downside.