- BP Stock price was on an uptrend in mid-September but has recently been on a decline. We tell you what this means for the new month.

BP plc (LSE: BP), one of the world’s largest energy companies, has seen its stock price drop recently, underperforming compared to several of its rivals and broader market indices. It looks like the pressure is coming from a mix of lower profits, uncertainty over its business strategy, and a more conservative macro climate.

Why BP Stock Is Under Pressure

The impression of strategic uncertainty, particularly regarding the company’s stance on the production of traditional fossil fuels and its plans to shift to low-carbon energy sources, is a major source of investor anxiety. BP had originally set itself up with a bold plan for going green.

However, it has since changed its mind to cut down investments in renewable energy and put more focus back on oil and gas development. This change of direction, which some might say is a smart move given the current energy situation and shareholders’ aspirations for better profits, has caused strategic uncertainty.

Investor activity has also put pressure on BP stock price. Hedge fund Elliott has been pushing the company to cut expenses more, simplify its portfolio, and bring in more free cash flow. Activist involvement can occasionally boost share prices. However, in BP’s case, it has made investors wonder if management can find the proper balance between long-term investment and short-term shareholder returns.

Elliott Management, which is said to own 5% of the company, has been calling for a stronger focus on core oil and gas. Concerns about debt are still there, with net borrowings around $24 billion, which limits aggressive capital returns as interest rates rise. These factors have come together to pull BP below its 50-day moving average of $35.50. That demonstrates that the market is less optimistic about its 34% earnings growth outlook and more worried about the risks of making a low-carbon pivot.

At the same time, BP is at the mercy of the global oil price, just like all other major energy companies. Rising interest rates, inflation, and concerns about a global economic slowdown have merged to raise the likelihood of reduced demand for oil and gas. There is a general trend for the BP share price to follow the decline in Brent crude.

What to Expect in October

As we look ahead to October, the mood is cautiously optimistic. The Q3 2025 earnings report, which usually is released in early November, makes October a critical month. Investors will be waiting for these outcomes through the month of October.

The optimistic expectation is that BP will be able to prove that its refocus on to its core oil and gas segment is paying off and that it is handling the volatility that happened in the first quarter. In October, the best thing that could happen for the stock would be a great earnings report that outperforms expectations and a clear update on the buyback program that is good for shareholders. On the other hand, any more disappointment could bring back the strategic uncertainty and activist pressure.

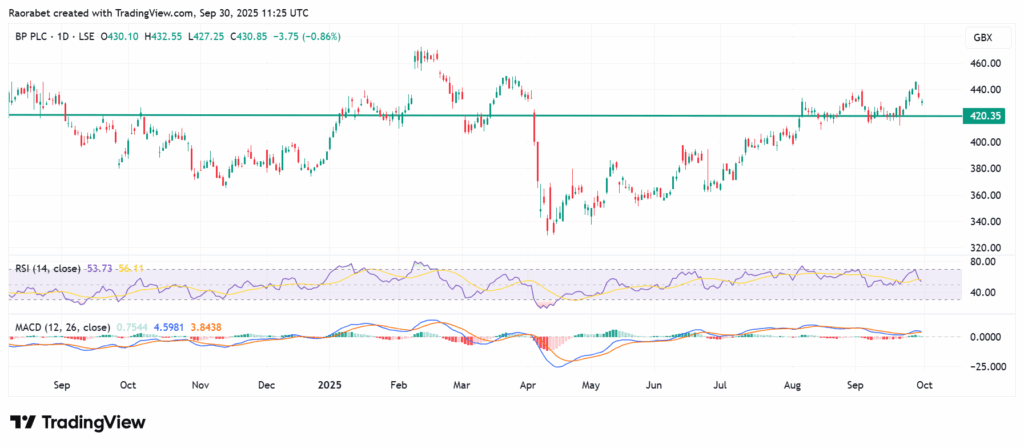

Technical analysis shows some short-term warnings, like an RSI that has been swinging between neutral–to bearish levels. This could imply that the market could be in for a short period of bearish pressure or consolidation before BP share price moves up. October will be a very important test of whether the recent upward trend seen in mid-late September can break past key levels of resistance.

BP stock price has support at 420p with the RSI and MACD signaling neutral and weak momentum

BP’s underperformance is due to strategic uncertainty around its green transition pivot, disappointing earnings, and concerns over the impact of pressure from activist investor Elliott Management.

BP adjusted its strategy to go slow on renewables investment and increased its focus on core oil and gas production to boost immediate returns.

The primary catalyst is the Q3 2025 earnings, which will test if the focus on core oil and gas production is delivering improved returns.