Bajaj Auto delivered a stronger-than-expected set of Q1 results on Wednesday, reporting a 30% surge in net profit as exports picked up and margins held firm. Net profit came in at ₹2,012 crore, well above analyst estimates of ₹1,830 crore, while revenue for the quarter rose 24% year-on-year to ₹11,709 crore.

A big part of the beat came from better pricing and a solid recovery in overseas markets like Africa and Latin America. Higher export volumes, especially in premium bikes and three-wheelers, helped push margins to 20.5%, the best Bajaj has seen in six quarters.

Bajaj Auto’s results come at a time when most auto OEMs are battling demand softness in domestic markets. The company appears to be bucking that trend, leaning on overseas momentum and cost controls to protect its bottom line.

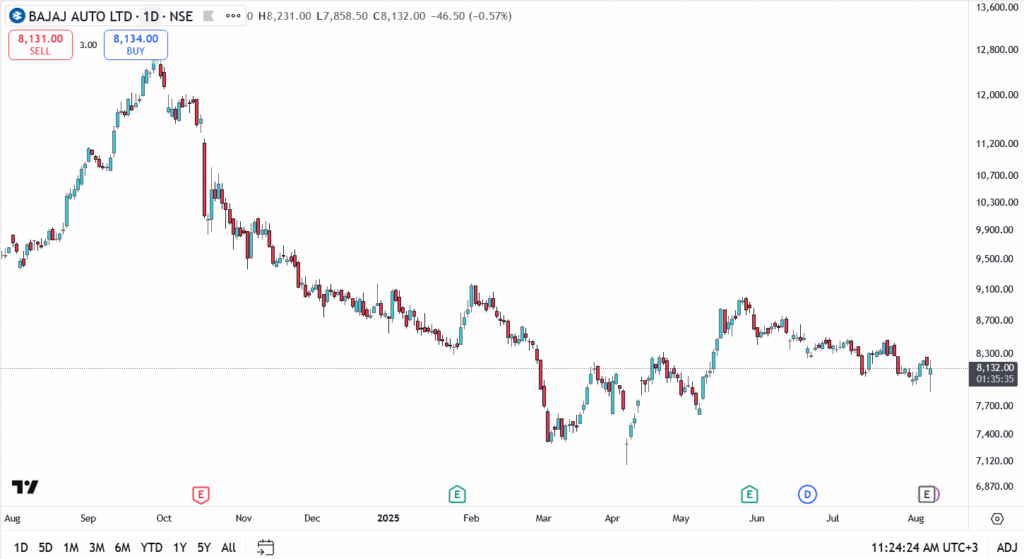

Bajaj Auto Share Price OutlookBajaj Auto Chart Analysis

- Current price: ₹8,132

- Resistance: ₹8,300 and ₹8,500

- Support: ₹8,000, then ₹7,800

Price action is weakening, with candles showing lower highs and soft demand zones. A close below ₹8,000 could open the door to ₹7,800. On the upside, bulls need a clean break above ₹8,300 to shift the bias.

Conclusion

Bajaj Auto showed up where it matters, strong margins, rising exports, and a clean beat on the bottom line. The stock may be taking a breather, but the business looks anything but tired. With global shipments gaining traction and cost control intact, the setup heading into H2 looks solid.

As long as export demand holds and margins stay north of 20%, Bajaj Auto isn’t just holding its ground, it’s pulling ahead of the pack.