- Alibaba raises $3.2 billion through zero-coupon convertible bonds to boost cloud and AI infrastructure, BABA stock surges.

Alibaba Group shares are up about 10% since the rally began last week, with buying momentum accelerating as investors cheer the company’s aggressive push into artificial intelligence and its shift away from U.S. chip reliance. The company’s Hong Kong-listed shares climbed 5.9% to HK$151.80 (about US$19.49), their highest level since November 2021, while U.S.-listed BABA stock has now pushed through $158, marking its strongest level in nearly four years.

Roughly 80% of the new funding will go toward reinforcing Alibaba’s cloud backbone, expanding data centers, upgrading infrastructure, and enhancing services to support the surging wave of AI demand. The rest will fuel its global e-commerce arm, strengthening the company’s twin growth pillars of cloud and international retail.

AI Boom Powers Alibaba’s Cloud Growth

Alibaba Group is seeing the payoff from its AI push show up clearly in its cloud numbers. In its latest earnings, the company posted a 26% year-on-year jump in cloud revenue for the April–June quarter, fueled by soaring demand for AI model training and inference workloads.

Chief Executive Eddie Wu said “AI plus cloud” will remain one of Alibaba’s two core growth engines alongside e-commerce, adding that the company plans to invest at least $53 billion over the next three years to build out its AI and cloud infrastructure.

At the same time, Alibaba introduced its newest large language model, Qwen3-Next, built for deeper long-text understanding and designed to cut training costs dramatically. The move highlights Alibaba’s focus on making its AI stack faster, more cost-efficient, and less dependent on expensive third-party hardware.

Shifting Away from Nvidia: China’s Chip Push

In a major strategic move, Alibaba and fellow Chinese tech leader Baidu have begun training AI models on their own homegrown chips, signaling a pivot away from U.S. semiconductor suppliers amid export restrictions.

Alibaba’s semiconductor division has developed the Zhenwu processor to power cloud-based AI workloads, while Baidu is using its Kunlun P800 chips to train new versions of its Ernie large language model. These steps reflect Beijing’s drive for technological self-reliance after U.S. restrictions blocked access to Nvidia’s most advanced GPUs, including the H100 and upcoming Blackwell series.

For now, Alibaba and Baidu still rely on Nvidia chips for their largest training tasks, but the growing use of domestic chips marks a significant milestone. It reduces long-term cost pressures and positions these companies to align with China’s industrial policies aimed at cutting dependence on U.S. technology.

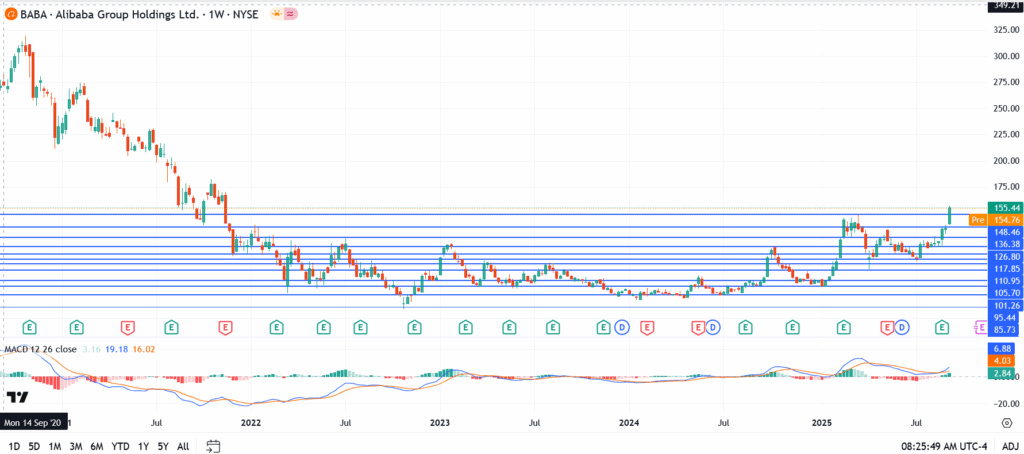

Alibaba Chart Analysis Today

- Current price: $158.10

- Support: $152,$144, and $136 if profit-taking sets in.

- Resistance: $165, $180 if momentum builds further.

Trade entry: Short-term traders may watch for pullbacks into the $152–$154 zone as a potential entry if support holds. A close below $152 could shift risk toward $144.

Alibaba Stock Outlook

Alibaba’s surge past the $158 level marks a clear breakout from its multi-month consolidation, fueled by renewed confidence in its AI roadmap and cloud growth. The company’s aggressive funding plan, rapid cloud revenue acceleration, and gradual shift to in-house chips give it strong long-term positioning in the global AI race.

If AI demand sustains and U.S. export restrictions keep pushing Chinese firms to innovate, Alibaba could gradually reclaim the $180-$200 zone in the coming quarters. While near-term volatility is likely, the market is beginning to re-rate Alibaba as a critical AI infrastructure player rather than just an e-commerce giant.

Alibaba FAQs:

Alibaba Group is raising $3.2 billion through zero-coupon convertible bonds to strengthen its AI push. About 80% of the funds will go toward expanding cloud infrastructure and data centers, while the rest will support its international e-commerce business.

Yes, partially. Alibaba and Baidu have started training AI models on their own chips to reduce reliance on Nvidia’s hardware after U.S. export restrictions. Alibaba’s Zhenwu chips are being used for cloud-based AI tasks, marking a major step toward self-sufficiency.

BABA shares jumped about 8% as investors cheered its aggressive AI investments, strong cloud revenue growth, and the move toward in-house chips. The rally pushed the stock to new 52-week highs, drawing renewed interest from growth-focused traders.