The Royal Mail share price has opened trading for the week sharply lower as investors react negatively to the company’s troubles on several fronts. Apart from strike threats, the company faces backlash over its recently announced plans to split and rebrand its UK business.

The company recently announced it was splitting its business and would rename the brand to International Distribution Services. The last Royal Mail share price review on this site carried this story.

The Communication Workers Union (CWU), representing a large section of workers at the Royal Mail Group, are up in arms just weeks after serving a strike notice to the company. The union fears that the plans by the Royal Mail Group to split the business would result in job losses. Furthermore, the CWU says it is at odds to understand the decision, given that the company had reported good earnings for the last fiscal year. Nevertheless, CWU continues to maintain its stand that the company’s workers deserve a more significant pay increase than what the company has offered.

The Royal Mail share price is down 1.64% as of writing.

Royal Mail Share Price Forecast

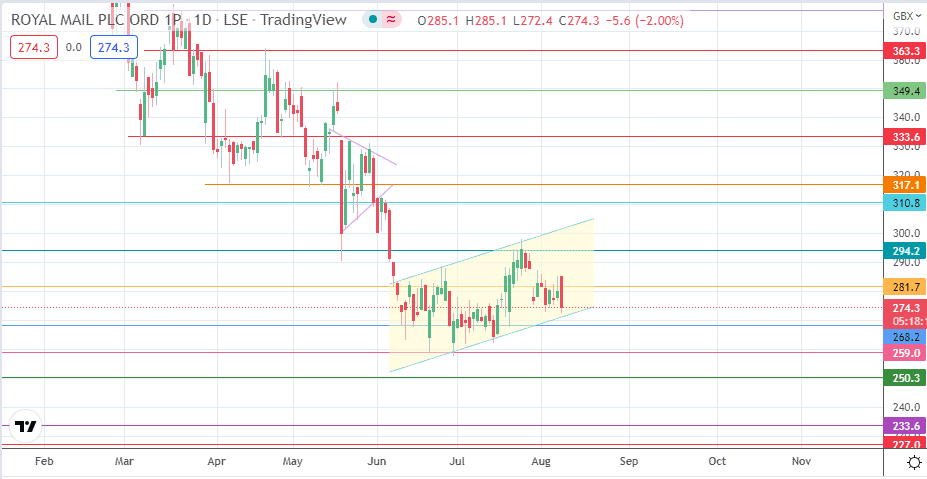

The active daily candle’s drop below 281.7 following the bullish gap open has formed a bearish engulfing pattern at that level, with the action not only preserving the status of this price mark as resistance but also pushing the price action for a test of the lower border of the evolving flag. A breakdown of this border must be followed by a degrading of the 268.2 support level to confirm the pattern.

The bearish flag’s measured move aims for completion at the 250.3 support (10 November 2020 low) and thus requires the bears to break down the 259.0 support level (30 June low). The 233.6 support level formed by the prior low of 24 December 2019 becomes the new target for further price deterioration, followed by the 2 November 2020 low at 224.7.

On the flip side, the pattern is invalidated if the bulls force a bounce on the lower border that takes out sequential resistance levels at 281.7, 294.2 (21/26 July high) and 310.8 (7 June high). This move opens the door for a recovery move that targets 317.1 (12 May 2022 low) and 333.6, where the 27 April 2022 low is found.

Royal Mail: Daily Chart