The Royal Mail share price has continued to hold strong despite data showing the company struggling financially and failing to meet its revenue expectations. This month, the share price is up by 2 per cent following a three-day rout in the stock markets that resulted in a drop of almost 5 per cent.

According to recent reports, Royal Mail reported a £1 million a day loss, which prompted it to threaten to split the company into two, which would mean separating its domestic and international business under a rebranded holding company called International Distributions Services. The company also announced an adjusted operating loss between April and June of £92 million. Its revenue is also down 11.5 per cent.

Royal Mail has struggled in the markets due to plunging deliveries of the Covid-19 test kits and items bought online. The company has also continued to experience a long-term decline in letter deliveries and a disappointing performance in running the company more efficiently.

Last week, a UK postal union strike mandate that was voted by 115,000 of the Royal Mail staff called for a strike against the company’s planned 2 per cent pay rise. The vote, in which 97.6 per cent of workers voted in favour, will see a company already struggling to make significant operational changes affected by workers sitting out in protest over the lack of proper compensation. Moreover, there is a high likelihood that the current company’s problems will only be exacerbated should the strike move forward.

Royal Mail Share Price Analysis

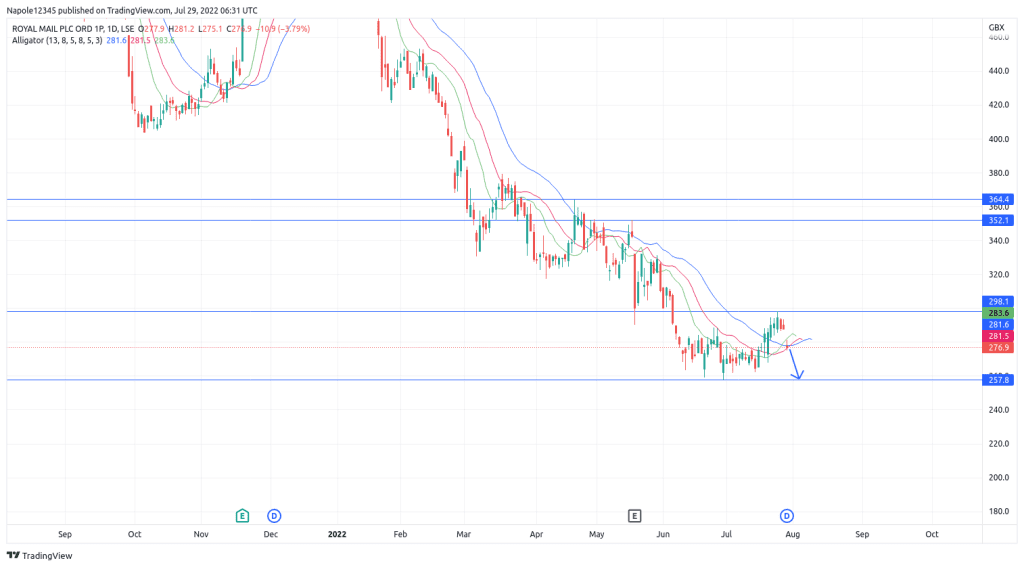

Despite having been able to perform well throughout July, the next few trading sessions may be a continuation of the past three days, where prices have closed with a loss. Looking at the chart below, there is a high likelihood that we will continue seeing a drop and my price expectation is for the share price to drop by long-term Royal Mail analysis is also bearish with250p.

My analysis, however, will be invalidated should the prices hit the 298 price level. At that point, it will be clear that the markets are bullish and Royal Mail is poised to continue going up.

Royal Mail Daily Chart