The Rivian stock price has bounced off its all-time low at 30.66, but the 0.88% upside recorded on the day has not fundamentally changed the bearish Rivian stock price predictions. Rivian Automotive Inc has seen its stock price nosedive since its 16 November high at 179.47. A flurry of bearish patterns and Elliot wave sequences has provided several opportunities for traders who were interested in shorting the stock.

The recent recovery that saw the Rivian stock price heading from $35.10 to the 30 March 2022 high at $56.76 did not change the Rivian stock price predictions as this move was merely a rally on which sellers initiated new selling orders. Fundamentally speaking, there has been nothing of note to drive a recovery in the Rivian stock price. Its car delivery update delivered three weeks ago did not contain any bullish surprises.

The 2,553 cars the company said it produced in the first quarter and the 1,227 vehicles it delivered in the same period were within expectations. How well the company tracks its ambitious 25,000-vehicle delivery target for 2022 is what determines when bullish Rivian stock price predictions come into play.

Rivian Stock Price Prediction

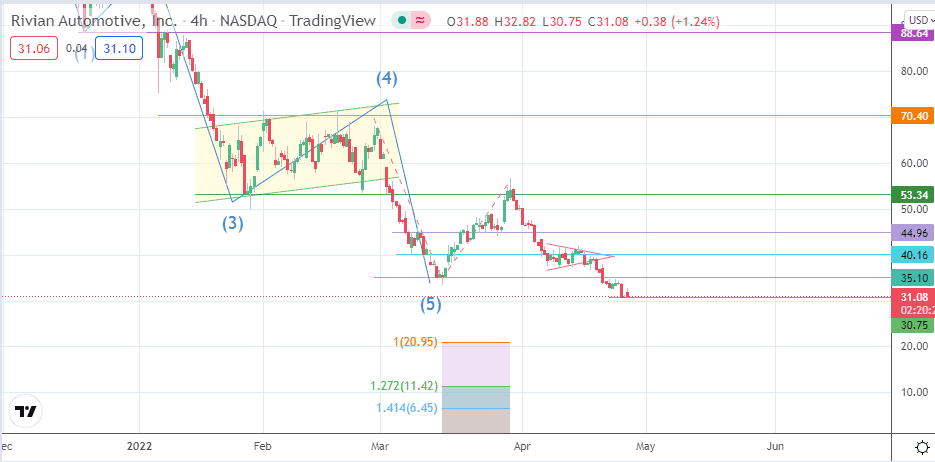

After completing the 1-2-3-4-5 impulse wave to the south, the corrective wave sequence has not played out as expected. The rejection of the advance at 53.34 has ushered in a wave of selling, with the breakdown of the 35.10 price support reflective of the measured move of the smaller bearish pennant pattern on the daily chart.

The price bounce at the 26 April low of 30.66 has turned this area into the support to beat. A breakdown of this level opens the door for a push lower, targeting 20.95 as a potential pivot. This is the site of the 100% Fibonacci extension from the price swing of 28 February to 15 March and concluding with an upward swing to 30 March.

Below the 20.95 potential pivot, 11.42 and 6.45 are potential targets to the south, being the 127.2% and 141.4% Fibonacci extension levels, respectively. On the flip side, the bulls need to extend the bounce on 30.66 towards the 35.10 price mark (15 March low and 25 April high).

A further advance requires a break of this barrier, targeting additional northbound targets at 40.16 (14 March low) and 44.96 (9 March high). The 50.00 psychological price level and the 53.34 price mark are other targets to the north which are presently out of reach of the bulls, staying as upside targets for the future.

RIVN: 4-hour Chart

Follow Eno on Twitter.