The Rivian stock price prediction indicates a high potential for the stock to open on a negative note this Tuesday as market participants try to digest the implications of Ford’s sale of shares it held in Rivian. The Rivian stock price fell 6.89% on Monday after Ford motor company sold the 7 million shares it held in the EV maker Rivian Automotive Inc.

Ford remains a shareholder in Rivian, holding 86.9 million shares. However, the sale of nearly 9% of its total holdings was enough to spook investors, leading to the slide in the stock.

The Wall Street Journal says that Rivian has filed a lawsuit against seat supplier Commercial Vehicle Group. The dispute stems from the decision of the seat supplier to hike prices. The lawsuit claims the price hike violated the contractual agreement between both companies. The supplier has issued a rebuttal, saying that a change in the seat design by Rivian necessitated the price hike. However, it also said there was nothing in the contract stopping it from raising prices.

Pessimistic Rivian stock price predictions were triggered last week when the company reported a loss of $1.6 billion in the first quarter of 2022. However, its cash reserves of $17 billion and its 100,000 pre-orders could help the company bring in $15 billion in revenue this year, not counting Amazon’s pre-order of 100,000 EDVs. This scenario is expected to recover the Rivian stock price to the 12-month targets set by institutional investors at 51.50.

Rivian Stock Price Prediction

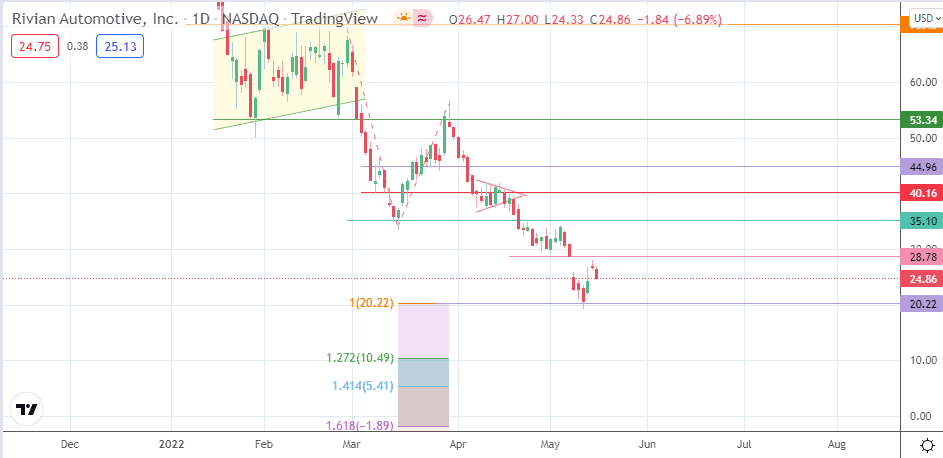

A decline would set up a challenge for the bulls at the 20.22 support, where the stock found recent all-time lows. A decline below this level will bring up new potential pivots at 10.49 (127.2% Fibonacci extension level) and possibly at 5.41 (141.4 % Fibonacci extension level).

On the flip side, recovery will have to follow a resistance break at 28.78 (6 May low). This move also covers the down gap of 9 May and clears a path for the bulls to attack the 35.10 barrier (25 April high). A breach of 40.16 and 44.96 (8 March 2022) allows for another advance that brings the stock closer to the 12-month target. Finally, a breach of 44.96 allows the bulls to have clear skies towards the 53.34 barrier (29 March high).

Rivian: Daily Chart