Rivian’s stock price has struggled throughout the year and is currently down by 73 per cent year-to-date. However, yesterday’s trading session closed with a price gain of 4.5 per cent.

Why Does Rivian Stock Continue to Drop?

The underperformance of Rivian stock has been due to a number of factors, such as the rising cost of production and the Shanghai COVID lockdowns that affected its ability to produce new electric vehicles. Nevertheless, in a recent analysis done by Mizuho, an investment bank based in Japan, Rivian was able to deliver 400 electric trucks per month in the first quarter of 2022.

The company only managed to record 500 deliveries in the first two months of the second quarter. While this may seem impressive, it is still low, and the estimated 3,900 trucks by the company may not be hit for the second quarter. This will likely affect the company’s bottom line and result in stock prices falling.

Rivian has also had to face competition as more companies invest in the electric car market. Unlike in the past, when only a handful of companies dominated the industry, companies such as Ford and Volkswagen have also entered the industry. These brands will pose a challenge to Rivian in the future and slice into its market share.

Rivian Stock Price Prediction

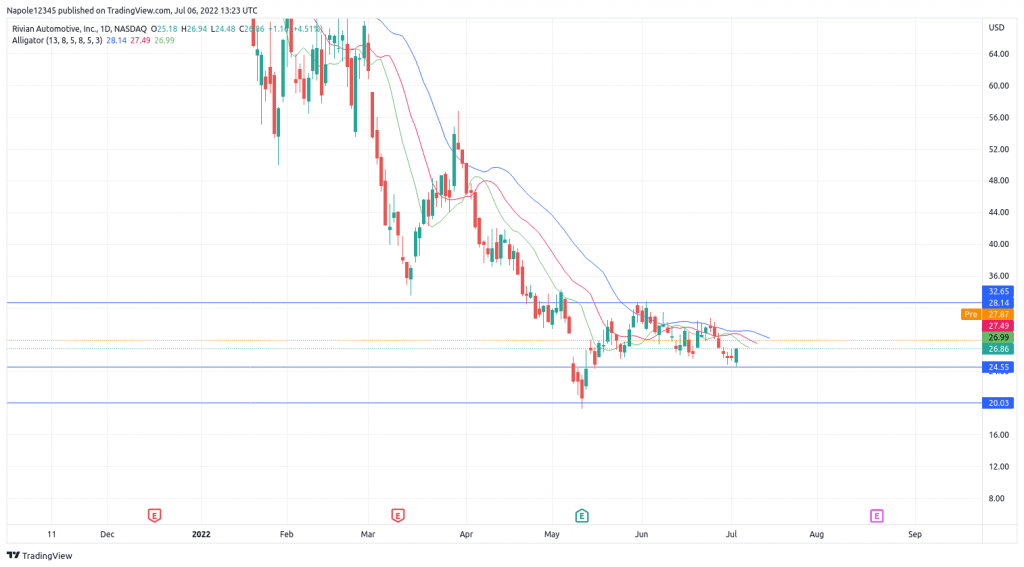

Despite yesterday’s strong bullish push that resulted in a 4.5 per cent price surge, my Rivian stock price prediction still expects the bearish trend to continue. As a result, we will likely see the prices drop to trade below the $20 price level in the next few trading sessions.

My analysis is based on the assumption that the current market conditions, such as high rates of inflation and the cost of production, will not end soon. On the flip side, the pre-market data is showing the likelihood of a strong bull move today. If that is the case, then my bearish analysis based on the past few days’ price action will be invalidated.

Rivian daily Chart