Bullish Ripple price predictions remain precarious as the 0.85% uptick in price movement this Tuesday remains unconvincing in terms of protecting the current support level. Furthermore, the upside push requires additional momentum, which is lacking at the moment.

The lack of reasonable bullish action on the XRP/USDT pair follows that of its correlated asset pairing, BTC/USDT. Bitcoin prices are also trading in a tight intraday range, which explains the reluctance of traders on the Ripple pairs to take extra risk. The Ripple price prediction indicates that this situation could leave the immediate support at 0.7975, vulnerable to a bearish onslaught.

On the fundamental side of things, the Ripple team, along with co-defendants Brad Garlinghouse and Chris Larsen, have opted not to challenge the motion by the SEC to redact a portion of notes in the existing XRP vs SEC case. The notes in question are handwritten memos taken by SEC staff during meetings held between the commission and third parties from 2014 to 2018. As a result, both parties could file a joint scheduling order by 22 April as the case winds to a long-drawn conclusion.

Ripple Price Prediction

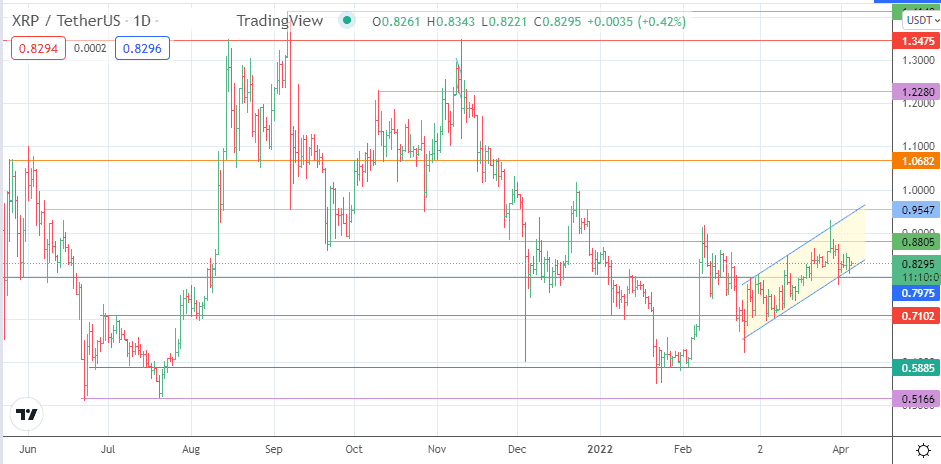

The violation of the lower border of the channel’s trend line puts that border under threat. However, the downside push only happens if the bears take out this border and the support level at 0.7975 (18 December 2021 and 21 March 2022 lows). If these pivots give way, the bears would have a clear coast to march towards the 0.7102 support level (5 January/5 March 2022 lows). Other pivots include the 27 January/3 February lows at 0.5885 and the 23 June/20 July lows at 0.5166.

On the other hand, the bulls need to protect the 0.7975 support and the channel’s lower border to keep the channel intact. A bounce from the current levels would be enough to take the price activity towards the channel’s return line at the point of intersection with the 0.8805 resistance (8 December 2021/29 March 2022 highs). Above this level, 0.9547 forms a resistance barrier before the 1.000 psychological resistance mark constitutes a pitstop to upside movement.

XRP/USDT: Daily Chart

Follow Eno on Twitter.