- Rio Tinto share price is attempting to rebound as investors focus on the performance of key commodities. What next for RIO stock?

Rio Tinto share price is attempting to rebound as investors focus on the performance of key commodities. The RIO shares were trading at 4,815p on Friday, which was about 25% below the highest point this year. This means that the stock has moved to a bear market. It has a market cap of over 138 billion pounds, making it one of the biggest mining companies in the world.

Rio Tinto is facing challenges

Rio Tinto is the second-biggest metal mining company in the world. It is an Anglo-Australian company that focuses on some of the most useful metals in the world like iron ore, aluminum, copper, borates, lithium, diamonds, salt, and titanium dioxide. The firm has a substantial market share in all these metals.

Rio Tinto, like other mining companies, went through an exciting period during the pandemic as the prices of most commodities rose. Recently, however, this joy has turned to misery as the prices of most commodities has pulled back sharply from the highest point in 2021.

In July, Rio Tinto published extremely weak results as the prices of most commodities dropped. Its underlying profit dropped to $8.6 billion in the first half of the year from the previous $12.2 billion. Most importantly, the company decided to more than half its dividend payout. The firm will pay a dividend of $4.3 billion, down from the previous $9.1 billion.

The company’s decision to lower its dividend yield is likely because management expects that the mining industry will go through substantial challenges in the coming months. The management also hopes to have enough dry powder to acquire companies. For one, the firm hopes to become a leading player in metals vital for the “green transition.”

Rio Tinto share price forecast

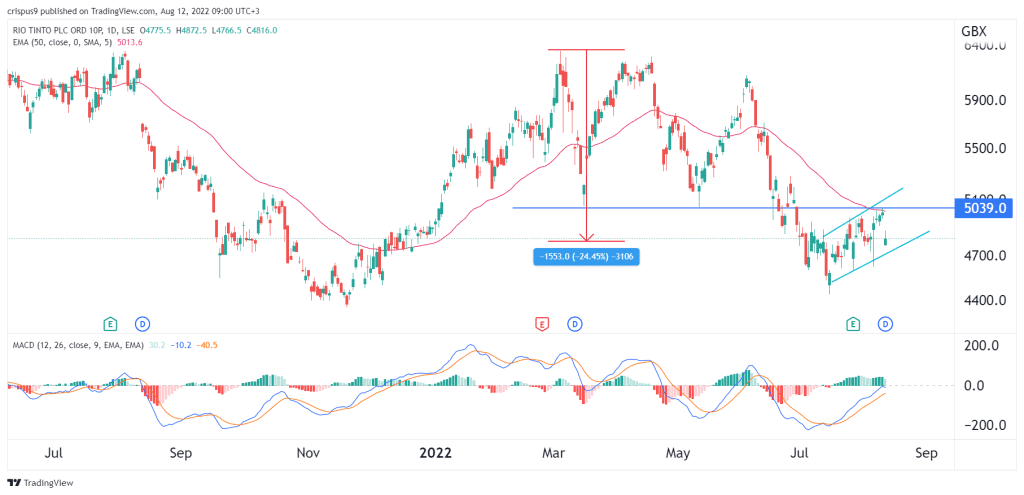

The daily chart shows that the RIO share price formed a triple-top pattern this year. In price action analysis, this pattern is usually a bearish sign. The stock then managed to move below the important support level at 5,039p, which was the lowest level on May 12th. It has now formed a break and retest pattern by retesting that point.

Therefore, the shares will likely resume the bearish trend as sellers target the next key support at 4,450p, which was the lowest point on July 15. A move above the resistance point at 5,000p will invalidate the bearish view.