- The price of TRX hit highs around the $0.18 level back in May, but has been unable to find a bullish path in the recent market rally.

The price of TRX hit highs around the $0.18 level back in May, but has been unable to find a bullish path in the recent market rally.

Despite, this I will explain why TRX could be a dark horse in the cryptocurrency sector. The recent rally in BTC was built on the news that the coin was to see an ETF launched on the ew York Stock Exchange. Since that product came to the market, another two ETFs were launched.

One of the ETF products was created by Valkyrie Digital Assets and the reason I would look more closely at TRX is that the coin’s founder, Justin Sun, is a large investor in Valkyrie. Is it possible that the company go for the obvious top two coins for an ETF and then add a TRX ETF?

The largest gold ETF has a market cap of $58bn and that would not make a dent in the BTC market value of over a trillion. But, TRX has only a market cap of $6.8bn so a retail product could add considerable steam to the coin.

Etoro added TRX staking to its Australian platform this week and another recent addition was the Van Eck Tron ETN to the German Deutsche Borse exchange. Justin Sun understands the path to retail adoption and one day investors and the market may fulfill his dreams.

TRX Price Analysis

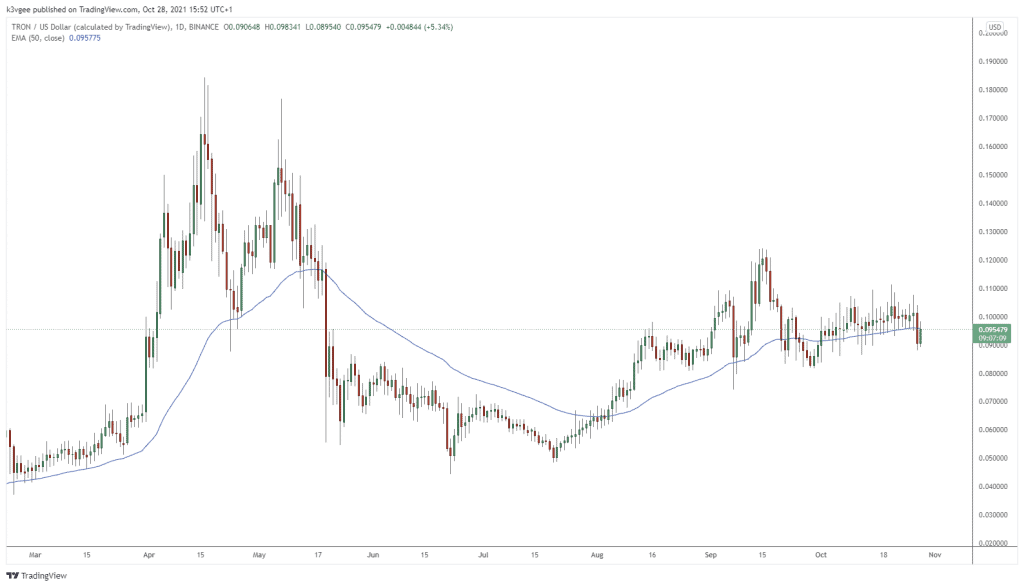

The TRX price hit highs of $0.18 in the bullish market of May but quickly dropped to lows around the $0.05 level in June. The coin has recovered to trade around the $0.10 price level but there is a risk of further lows after this week’s sell-off.

TRX Price Chart (Daily)