- What is the outlook of the NZD/USD ahead of the RBNZ interest rate decision scheduled for Wednesday this week?

The NZD/USD pair crashed to the lowest level since October this year as the Reserve Bank of New Zealand (RBNZ) started its monetary policy meeting. The pair is trading at 0.6930, which is about 4% below its highest level in October.

What happened? The NZDUSD pair has been in a spectacular rally mostly because of the rising US dollar. Indeed, the dollar index has jumped to the highest level in more than a year as investors price in a more hawkish Fed.

The pair declined on Tuesday ahead of the RBNZ decision that comes on Wednesday. Analysts expect that the central bank will continue maintaining its hawkish stance. Precisely, they see it hiking interest rates by about 25 basis points to 0.75%. This will be the second consecutive rate hike by the RBNZ and is happening because the country’s economy has recovered from the pandemic.

Therefore, the NZD/USD pair is falling because more tightening by the RBNZ has already been priced in. At the same time, there are expectations that the Fed will also start tightening.

NZD/USD forecast

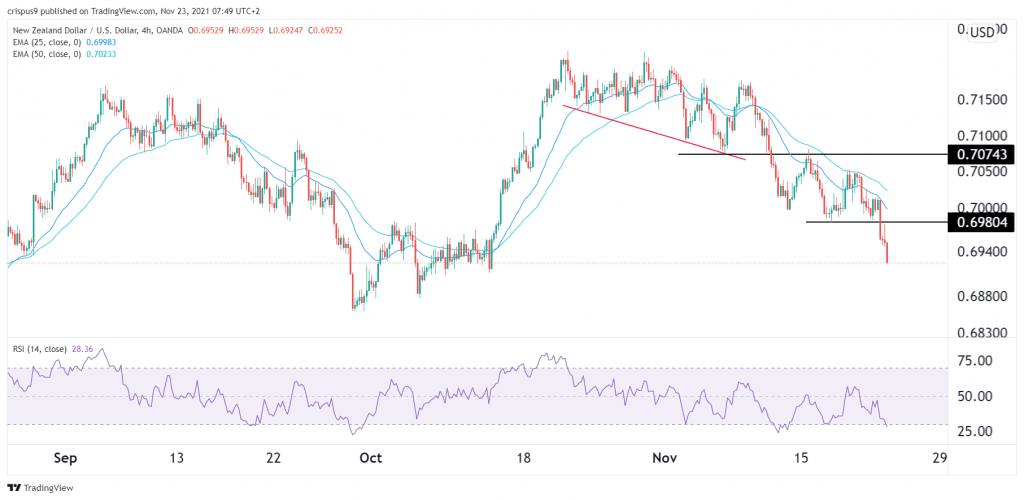

The New Zealand dollar has been in a major sell-off in the past few weeks. This sell-off accelerated when the price dropped below the key support level at 0.7075, which was the lowest level on November 5. Along the way, the pair has moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved to the oversold level.

Therefore, while the overall trend is bearish, the NZD/USD will likely have a relief rally after the RBNZ decision on Wednesday. If this happens, it will likely retest the resistance level at 0.6980, which was the lowest level on November 17.