- USDCAD trades in thin trading range today while it gives up some pips after dismal economic data from U.S. As the dust from the Phase One trade deal settles

USDCAD trades in thin trading range today while it gives up some pips after dismal economic data from U.S. As the dust from the Phase One trade deal settles down, investors turn now their attention to macro data.

On the data front today, the US initial jobless claims came in at 234K above the estimates of 225K, the four-week average climbed from the previous 224K to 225.5K on December 13. The Philadelphia Fed Manufacturing Survey came in at 0.3 below expectations of 8 in December. The United States Current Account came in at $-124.1B, below forecasts of $-122.1B in the third quarter.

From Canada the ADP Employment Change came in at 30.9K below expectations of 66.6K in November. The Wholesale Sales (month over month) came in at -1.1% below estimates of -0.1% in October.

Read our Best Trading Ideas for 2020.

USDCAD Technical Levels

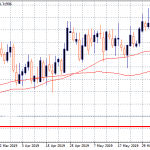

USDCAD made an attempt earlier today to recover some of yesterday’s sharp losses but the disappointment from the economic data has turned negative. The pair is under selling pressure since the end of November and reached monthly lows.

On the technical side, immediate support for USDCAD stands at 1.3106 the daily low, while a break below that level will open the way for a move down to 1.3073 the low from October 30th. Next target for the bears on the downside is the low from October 29th at 1.3041.

On the other hand, first resistance for the pair will be met at 1.3125 the daily high. More offers will emerge at 1.3175 the high from December 18th. Next resistance awaits at 1.3192 the 50-day moving average.